Introduction to AICPA Life Insurance

Life insurance is one of the most important financial protections for professionals and their families. For Certified Public Accountants (CPAs) in the USA, the American Institute of Certified Public Accountants (AICPA) offers exclusive group life insurance plans designed to meet the needs of its members.

Unlike traditional private insurers, AICPA life insurance works on a group coverage model, which can make it more affordable and easier to access. Members can choose between Traditional Term Life and Level Premium Term Life, depending on their age, career stage, and long-term needs.

The rising cost of insurance and the complexities of choosing the right plan have made many CPAs curious: Is AICPA life insurance really worth it compared to private life insurance policies?

👉 According to Investopedia, term life insurance remains one of the most cost-effective ways for professionals to secure coverage — but understanding whether group plans like AICPA’s are a good fit requires careful evaluation.

This guide will explore the benefits, drawbacks, rates, and alternatives to AICPA life insurance in 2025, so CPAs can make an informed decision.

Comparative Raters Auto Insurance (2025 Guide) | Save Time & Money

What is AICPA Life Insurance?

The American Institute of Certified Public Accountants (AICPA) is one of the largest professional organizations in the USA, representing CPAs and financial professionals. To support its members, the AICPA offers exclusive group life insurance coverage through a partnership with New York Life Insurance Company.

Unlike traditional life insurance policies purchased individually, AICPA life insurance is structured as group coverage, which means that eligible members pool together, and the risk is shared across the group. This structure often results in more affordable rates and simplified approvals compared to private insurers.

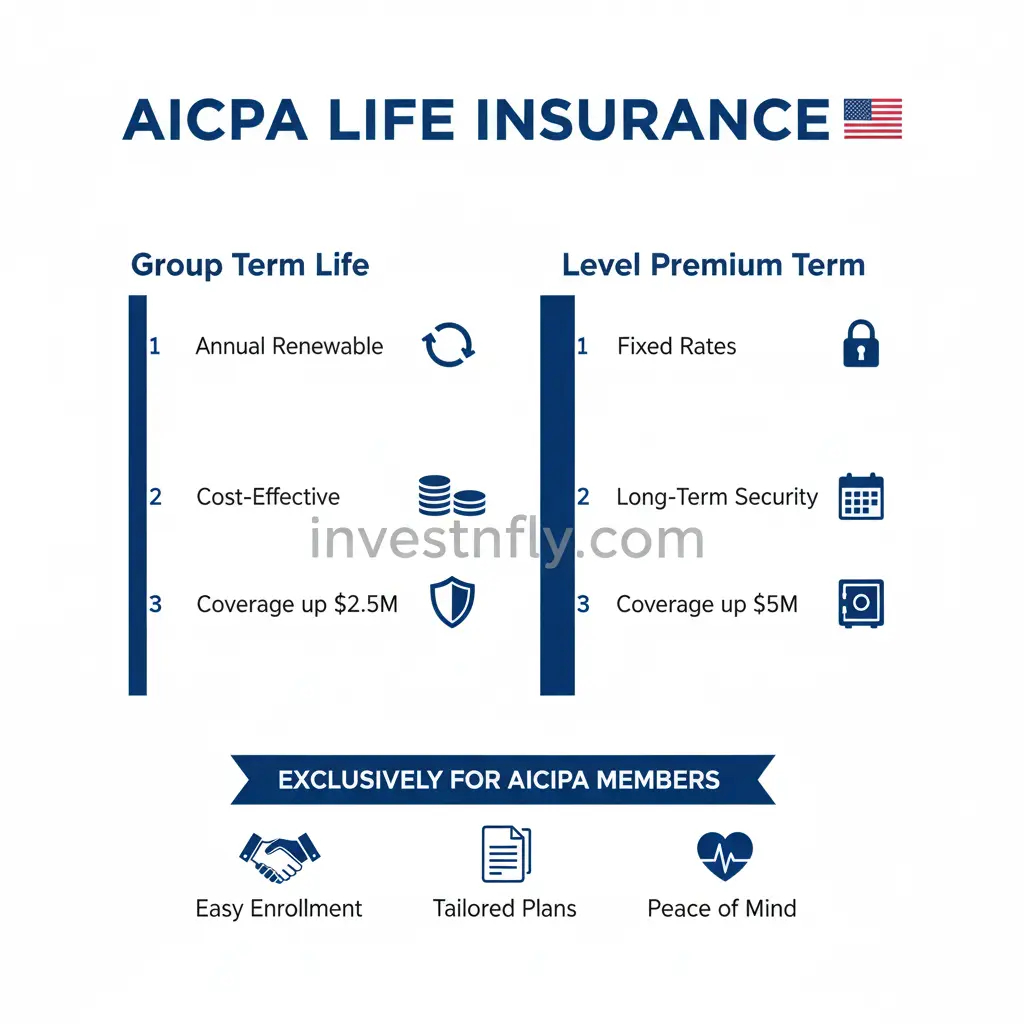

🔑 Key Features of AICPA Life Insurance

- Group Term Life: Designed for flexible, short-term coverage that increases with age.

- Level Premium Term Life: Locks in a fixed premium for a chosen term (10, 20, or 30 years).

- Coverage Options: Members can select coverage amounts tailored to their financial needs, from a few thousand dollars up to millions in death benefits.

- Exclusivity: Available only to AICPA members, their spouses, and sometimes dependents.

- Partnership with New York Life: One of the most reputable life insurance providers in the USA, ensuring financial stability and claims support.

📌 Why It Stands Out

- For CPAs: Tailored specifically for accounting professionals.

- Lower Costs Initially: Group rates may be cheaper for younger members.

- Trusted Provider: Backed by New York Life, which has an A++ financial rating from AM Best.

However, unlike private life insurance, premiums for some AICPA plans increase with age, making it more affordable in the short term but potentially costlier over the long run.

👉 According to the AICPA Insurance Trust, these plans are designed to provide flexible options for members at different stages of their careers.

Safex Insurance (2025 Guide) — Coverage, Claims & Best Alternatives

Types of AICPA Life Insurance

The AICPA offers its members two main types of life insurance coverage through New York Life: Traditional Term Life and Level Premium Term Life. Each option has unique features, costs, and best-use scenarios. Understanding the difference helps CPAs choose the right plan for their career stage and family needs.

1. Traditional Term Life Insurance

This plan is the default group coverage available to AICPA members.

Key Highlights:

- Coverage is renewable annually.

- Premiums increase with age in 5-year brackets (e.g., 30–34, 35–39, etc.).

- Designed for members who want flexibility and may not need coverage for decades.

- Provides higher coverage amounts during early working years when dependents and debts are higher.

Best For:

- Younger CPAs just starting their careers.

- Members who want temporary coverage with lower initial premiums.

- Professionals who anticipate their insurance needs will decrease over time.

2. Level Premium Term Life Insurance

This option locks in premiums for a fixed term (10, 20, or 30 years), similar to traditional private term policies.

Key Highlights:

- Predictable, fixed premiums for the chosen term.

- Ideal for long-term planning (mortgages, children’s education, or retirement protection).

- Coverage can go up to several million dollars, depending on eligibility.

- Premiums are higher at the start compared to Traditional Term, but they do not rise with age.

Best For:

- CPAs seeking long-term stability in premiums.

- Families with mortgages, dependents, or future financial commitments.

- Members who want to avoid surprise premium hikes later.

Quick Comparison:

| Feature | Traditional Term Life | Level Premium Term Life |

|---|---|---|

| Premiums | Increase with age every 5 years | Locked for 10, 20, or 30 years |

| Flexibility | High – renew annually | Moderate – fixed term commitment |

| Initial Cost | Lower for young members | Higher initially |

| Best For | Short-term or flexible needs | Long-term financial commitments |

👉 As noted by Forbes Advisor, locking in premiums early with a level term plan can save thousands over time, especially for younger professionals.

Fintechzoom.com Crypto News 2025 – Latest Bitcoin, Ethereum & Market Updates

Benefits of AICPA Life Insurance

One of the main reasons CPAs and their families consider AICPA life insurance is the set of member-exclusive benefits that are not always available with private insurance policies. Because this coverage is offered through the AICPA in partnership with New York Life, it brings both affordability and credibility.

✅ Key Benefits of AICPA Life Insurance

- Affordable Group Rates

- Group pricing makes initial premiums lower than many private policies.

- Especially cost-effective for younger CPAs entering the profession.

- Exclusive to Members

- Only available for AICPA members, their spouses, and in some cases dependents.

- Creates a professional network-based pool of policyholders.

- Trusted Provider (New York Life)

- Backed by one of the strongest insurers in the USA with an A++ AM Best rating.

- Ensures long-term stability and reliable claims management.

- Flexible Coverage Options

- Both Traditional Term and Level Premium Term choices available.

- Coverage amounts can be adjusted as financial needs change.

- Simplified Application

- For certain amounts and age brackets, medical exams may not be required.

- Fast approval compared to traditional underwriting.

- Supplemental Benefits

- Some policies include additional benefits like coverage for accidental death.

- Member discounts may apply if bundled with other AICPA insurance products.

📌 Why CPAs Like It

- Protects families and dependents from unexpected financial hardship.

- Provides peace of mind during high-pressure career stages.

- Initial affordability makes it attractive for new professionals starting out.

👉 According to NerdWallet’s life insurance guide, group life insurance can be a cost-effective solution for professionals, especially when paired with reputable providers.

Drawbacks & Limitations of AICPA Life Insurance

While AICPA life insurance provides valuable benefits to members, it isn’t the perfect solution for everyone. Like any group-based product, there are some drawbacks that CPAs should carefully consider before making a decision.

❌ Key Drawbacks

- Premiums Increase with Age

- Traditional Term Life coverage starts cheap but becomes more expensive as you enter higher age brackets.

- For members planning to keep coverage long-term, costs can add up quickly.

- Not Always the Cheapest in the Long Run

- While group pricing seems attractive at first, private term life policies may offer better value over 20–30 years.

- For younger CPAs who plan on holding insurance for decades, locking in a private policy may be cheaper.

- Limited Flexibility

- AICPA life insurance is tied to membership. If you leave the organization, coverage options may change.

- Conversion to permanent policies is often restricted compared to private insurers.

- Coverage Declines at Older Ages

- Maximum benefit amounts reduce as policyholders grow older.

- This can leave members underinsured during retirement years when financial needs may still exist.

- No Cash Value

- AICPA life insurance is term coverage only. Unlike permanent life insurance, it doesn’t build equity or savings.

📌 Bottom Line

AICPA life insurance is best for short- to mid-term protection and for members who value affordability and simplicity. However, it may not be the right choice for CPAs seeking long-term, flexible, or permanent coverage solutions.

👉 As noted by Forbes Advisor, many professionals combine group coverage with a private policy to balance affordability with long-term protection.

AICPA Life Insurance Rates (2025 Overview)

One of the most important questions CPAs ask before choosing AICPA life insurance is how much it costs. Since AICPA offers group coverage, premiums are based on age brackets, gender, and type of plan.

🔑 How Rates Work

- Traditional Term Life: Starts with low premiums for younger members, but costs rise every five years as you enter a new age bracket.

- Level Premium Term Life: Premiums remain fixed for the chosen period (10, 20, or 30 years), offering predictability but starting slightly higher.

- Coverage Amounts: Range from $100,000 to several million dollars, depending on eligibility and income.

Sample Rate Ranges (2025 Estimates)

| Age Bracket (Male, Non-Smoker) | Traditional Term (per $100K) | Level Premium Term (20 Years, per $100K) |

|---|---|---|

| 25–29 | $7–$9/month | $10–$12/month |

| 35–39 | $11–$14/month | $14–$18/month |

| 45–49 | $22–$28/month | $30–$36/month |

| 55–59 | $45–$60/month | $70–$85/month |

| 65–69 | $120–$150/month | Not commonly available |

(Note: These are illustrative estimates; actual rates vary based on underwriting, gender, health, and coverage amount.)

📌 Key Insights

- Younger CPAs get the lowest group pricing under Traditional Term.

- For members seeking predictability, Level Premium Term locks in costs but requires a higher upfront premium.

- After age 60, coverage becomes expensive and maximum benefit amounts start to reduce.

👉 According to the AICPA Insurance Trust, rates are periodically reviewed and updated, so members should compare current premiums with private term life quotes before enrolling.

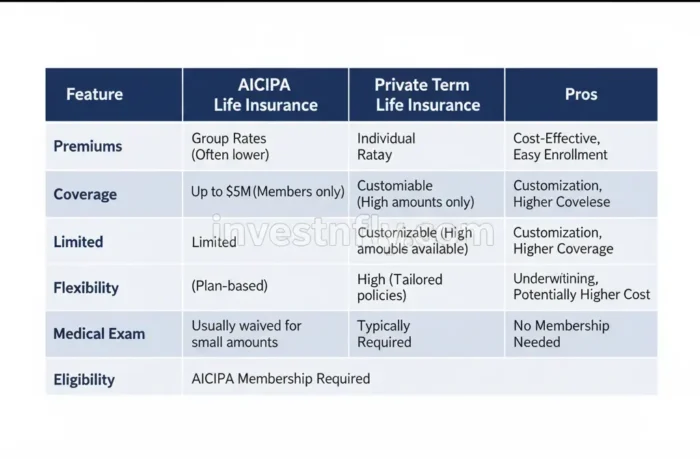

AICPA Life Insurance vs Private Life Insurance

When comparing life insurance options, CPAs often wonder whether AICPA group coverage is better than buying a private term life policy. The answer depends on age, health, and long-term financial goals.

🔑 Key Differences

1. Cost Structure

- AICPA: Lower premiums for young members, but costs rise every 5 years (Traditional Term).

- Private Term: Premiums are fixed for the entire term, often making it cheaper in the long run.

2. Eligibility

- AICPA: Only available to AICPA members and their families.

- Private Term: Available to anyone who qualifies, regardless of profession.

3. Flexibility

- AICPA: Coverage tied to membership; benefits may reduce with age.

- Private Term: Portable and customizable; you can choose riders, longer terms, or permanent coverage.

4. Application Process

- AICPA: Simplified underwriting; smaller coverage amounts may not require medical exams.

- Private Term: Typically requires full underwriting, but offers broader coverage options.

📊 Side-by-Side Comparison

| Feature | AICPA Life Insurance | Private Term Life Insurance |

|---|---|---|

| Cost (Short Term) | Cheaper for young CPAs | Higher at start |

| Cost (Long Term) | Increases with age | Fixed premiums, stable long term |

| Eligibility | AICPA members only | Open to all applicants |

| Flexibility | Limited, tied to membership | Wide range of policy options |

| Coverage Amounts | High, but reduce at older ages | High and stable throughout term |

| Portability | Limited | Fully portable |

📌 Which One Should You Choose?

- If you’re just starting out in your career and want affordable protection, AICPA life insurance is a solid option.

- If you need long-term stability and flexible coverage (e.g., mortgage, retirement, estate planning), private term life may be the better choice.

👉 As highlighted by Forbes Advisor, private insurers often beat group plans in the long run because of their predictable costs and flexibility.

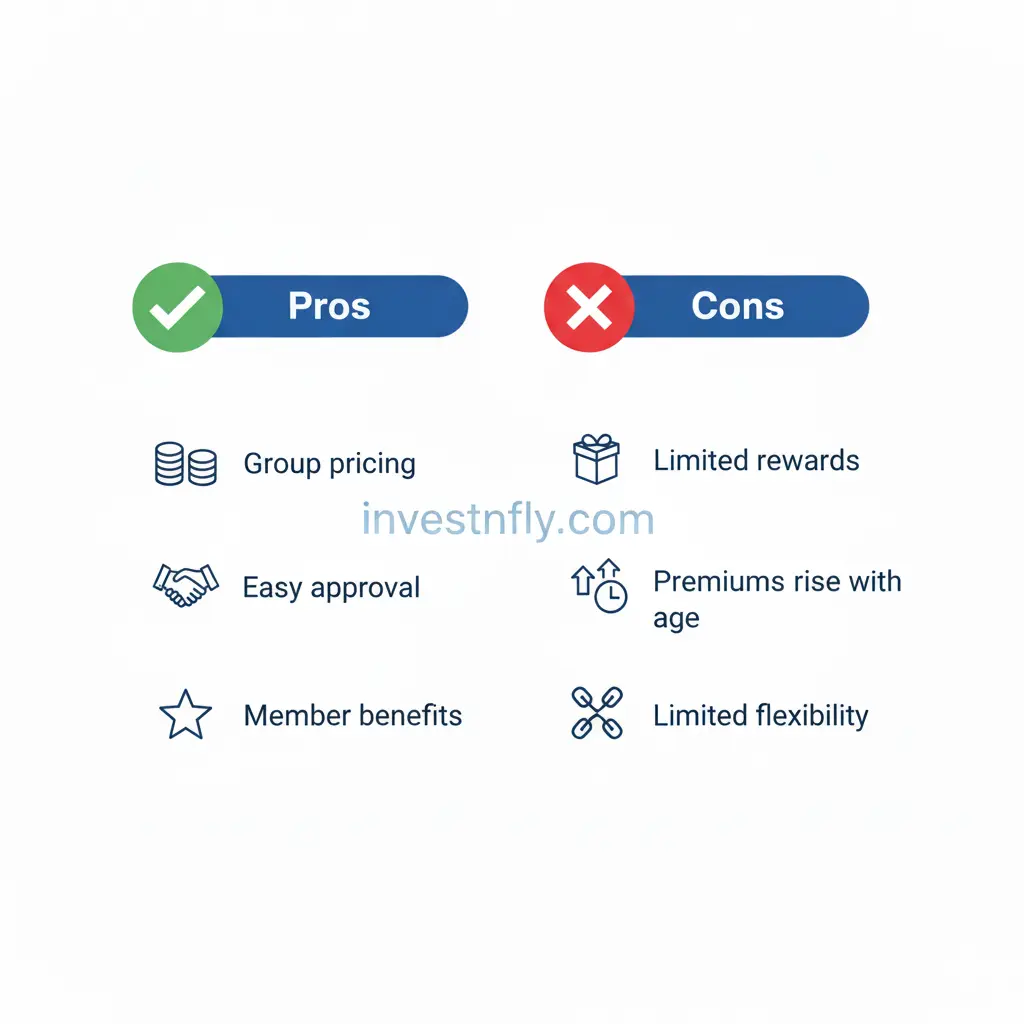

Pros & Cons of AICPA Life Insurance

Like any insurance product, AICPA life insurance comes with both strengths and weaknesses. For CPAs, it can be a convenient way to secure coverage, but it may not fit everyone’s long-term strategy.

✅ Pros

- Affordable for Young CPAs: Group pricing means lower initial premiums.

- Simplified Application: Minimal medical requirements for smaller coverage amounts.

- Exclusive Member Benefit: Only available through AICPA membership.

- Trusted Provider: Backed by New York Life, a top-rated insurer.

- Flexible Options: Choice between Traditional Term and Level Premium Term coverage.

❌ Cons

- Premiums Increase with Age: Can become expensive over time.

- Limited Portability: Coverage tied to AICPA membership.

- No Cash Value: Strictly term insurance, no investment component.

- Benefit Reductions: Coverage amounts may shrink at older ages.

- Not Always Cheapest Long-Term: Private insurers may offer better fixed-rate policies.

📊 Pros & Cons Table

| Pros | Cons |

|---|---|

| Affordable group rates for young CPAs | Premiums rise every 5 years |

| Simplified, quick application | No cash value or permanent coverage |

| Backed by New York Life | Limited portability after leaving AICPA |

| Member-exclusive benefit | Coverage reduces at older ages |

👉 According to NerdWallet, group life insurance can be a smart short-term option, but professionals should compare long-term costs with private insurers.

Special Investment Region (SIR): The 2025 Complete Guide for Global Investors

Who Should Consider AICPA Life Insurance?

Not every CPA or professional will benefit equally from AICPA life insurance. Because of its group pricing and structure, it is ideal for certain categories of members while less attractive for others.

✅ Best Suited For

- Young CPAs and Early-Career Professionals

- Premiums are lowest for younger age groups, making it affordable for those just starting their careers.

- Members Seeking Quick Coverage

- Simplified application and minimal medical exams make it convenient for busy professionals.

- Families with Short- to Mid-Term Needs

- Good option if you want coverage during working years to protect dependents and pay off debts.

- Spouses and Dependents of CPAs

- Some policies extend coverage to family members, offering additional protection.

❌ Not Ideal For

- Older Members

- Premiums rise significantly with age, making it costlier long-term.

- Those Wanting Permanent Insurance

- No cash value or investment component; only term coverage is available.

- Non-Members

- Only AICPA members (and eligible family) can apply, limiting accessibility.

👉 Bottom line: AICPA life insurance is best for young or mid-career CPAs who want affordable, reliable coverage. For long-term or permanent needs, exploring private insurers may be the smarter move.

Top 3 Index Funds in USA 2025 | Grow to $1M with Investnfly

FAQs About AICPA Life Insurance

❓ Is AICPA life insurance worth it?

Yes — for young CPAs, it can be a very affordable way to get life insurance coverage. However, for long-term needs, private term life insurance may provide more stability.

❓ Can I keep my AICPA life insurance after retiring or leaving the profession?

Coverage is generally tied to AICPA membership. If you retire but remain a member, you can usually continue coverage. Leaving the association may impact eligibility.

❓ How do AICPA life insurance rates compare to private insurers?

Initially, AICPA group rates are often cheaper. But over time, as premiums rise with age, private term policies may become more cost-effective.

❓ Does AICPA life insurance require a medical exam?

For smaller coverage amounts and younger applicants, medical exams may not be required. Higher coverage amounts typically require basic underwriting.

❓ Can spouses or dependents get coverage under AICPA life insurance?

Yes — many AICPA plans extend coverage to spouses and eligible dependents, making it a family-friendly option.

Conclusion

Life insurance is a vital part of financial planning for CPAs and their families. With exclusive access to AICPA life insurance, members can enjoy affordable group rates, flexible options, and the security of coverage backed by New York Life.

While it’s a strong choice for young and mid-career professionals seeking affordable protection, it may not always be the best long-term solution compared to private policies. The key is to evaluate your career stage, family needs, and budget before deciding.

👉 If you’re an AICPA member looking for reliable and affordable coverage in 2025, now is the perfect time to explore your AICPA life insurance options and secure your family’s financial future.