Introduction to British Seniors Life Insurance

Life insurance has become an essential part of financial planning for families across the UK, especially for seniors who want to make sure their loved ones are not left with unexpected costs.

Among the many providers, British Seniors Life Insurance has gained popularity for its straightforward policies, senior-focused coverage, and guaranteed acceptance for applicants over 50.

For many, British Seniors is a trusted name when it comes to Over 50s life cover. The brand markets itself as a reliable choice for older UK residents who may not qualify for traditional policies due to age or health conditions.

Its plans are often used to cover funeral costs, outstanding bills, or small inheritance gifts, making it a practical option for end-of-life financial planning.

But here’s the real question: Is British Seniors Life Insurance the best choice in 2025? While it offers guaranteed acceptance and fixed premiums, it also has some limitations like smaller payouts and relatively higher premiums compared to larger insurers.

This article provides a complete review of British Seniors Life Insurance in 2025. We’ll explore its benefits, drawbacks, typical costs, pros and cons, and compare it with competitors like SunLife, Aviva, and Legal & General.

👉 According to MoneyHelper UK, over-50s life insurance is designed to provide peace of mind, but choosing the right provider makes all the difference.

Best Travel Insurance for Moldova (2025) – Affordable Plans, Coverage & Cost Guide

Table of Contents

Company Overview – British Seniors Life Insurance

British Seniors is one of the most recognized providers of Over 50s life insurance in the UK. The company is part of the Phoenix Group, one of the UK’s largest long-term savings and retirement businesses. With millions of policyholders and decades of experience, British Seniors positions itself as a specialist brand for seniors who want simple, guaranteed life cover.

🔑 Key Facts About British Seniors

- Parent Company: Phoenix Group (UK’s leading savings & retirement business)

- Target Market: UK residents aged 50–80

- Main Product: Over 50s Life Insurance with guaranteed acceptance

- Regulation: Authorized and regulated by the Financial Conduct Authority (FCA)

- Claim Payout: Typically processed within 24–48 hours of required documents being received

One of the reasons British Seniors has built trust is its focus on simplicity and accessibility. Policies are easy to understand, require no medical exams, and premiums are fixed for life. For many UK seniors, this removes the anxiety of being declined because of age or health conditions.

In addition, British Seniors offers a Funeral Benefit Option, where up to £300 can be contributed directly towards funeral costs if arranged through Golden Charter, a leading UK funeral plan provider. This extra feature strengthens its appeal to families planning ahead.

👉 If you’re over 50 and looking for a guaranteed acceptance policy with quick claims and peace of mind, British Seniors Life Insurance is one of the most accessible names in the market.

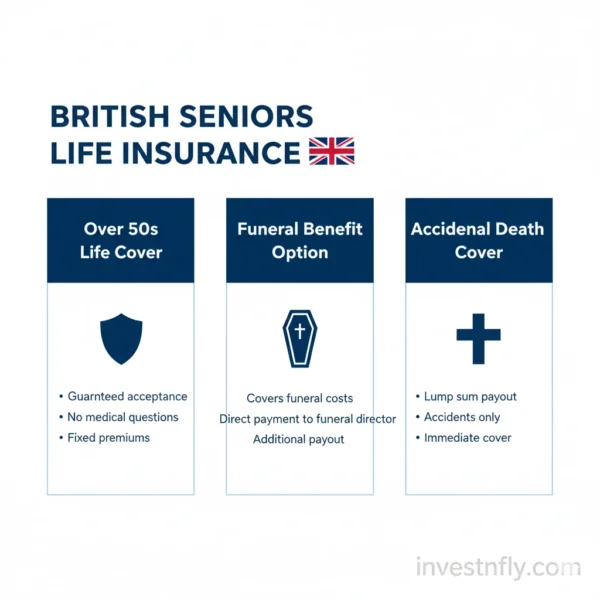

Types of Policies Offered by British Seniors Life Insurance

Unlike some UK insurers with complex products, British Seniors Life Insurance keeps things simple. Their policies are mainly designed for UK residents aged 50–80, focusing on guaranteed acceptance, affordable premiums, and family peace of mind.

🔑 Main Policy Types

1. Over 50s Life Insurance

- Guaranteed Acceptance: Available for anyone aged 50–80, regardless of health.

- No Medical Exam: Only basic questions, no health checks.

- Fixed Premiums: Your payments stay the same throughout the policy.

- Coverage Amounts: £1,000 – £10,000 (depending on age and premiums).

- Payout Purpose: Often used for funeral costs, small debts, or leaving a gift for loved ones.

👉 Ideal for seniors who want hassle-free approval and affordable cover to protect family members from unexpected expenses.

2. Funeral Benefit Option

- British Seniors partners with Golden Charter, one of the UK’s leading funeral plan providers.

- If this option is added, up to £300 contribution goes directly towards funeral costs.

- Families save time and stress when arranging services.

👉 Perfect for those who want a practical solution to funeral planning along with life insurance.

3. Accidental Death Cover (Optional Add-On)

- Provides an additional lump sum if death occurs due to an accident.

- Supplements the standard payout.

- Adds extra protection without significant cost.

👉 Helpful for policyholders who want extra peace of mind at minimal additional premium.

📌 Key Takeaway

British Seniors’ policies are straightforward, transparent, and senior-friendly. While coverage amounts are smaller than traditional term life, the ease of approval and funeral support make it an attractive choice for many UK residents over 50.

👉 According to MoneyHelper UK, over-50s plans are ideal for those who value simplicity and guaranteed cover, even if the payout is modest.

Loyal American Life Insurance Review (2025): Plans, Benefits, and Honest Alternatives

Benefits of British Seniors Life Insurance

For many UK residents, especially those over 50, British Seniors Life Insurance offers features that make it stand out from mainstream insurers. Its focus on simplicity, guaranteed acceptance, and family protection makes it one of the most convenient options in the market.

✅ Key Benefits

- Guaranteed Acceptance (50–80 years old)

- No medical exams or intrusive health checks.

- Acceptance guaranteed for all eligible applicants.

- Fixed Premiums for Life

- Your monthly premium never increases, no matter how old you get or if your health changes.

- Helps with long-term budgeting and peace of mind.

- Fast Claims Process

- Claims are usually paid within 24–48 hours once documents are provided.

- Families don’t have to wait weeks for funds during stressful times.

- Funeral Benefit Option

- Partnership with Golden Charter adds up to £300 towards funeral costs.

- Practical help for families handling final arrangements.

- Accidental Death Protection (Add-On)

- Additional payout if death occurs due to an accident.

- Provides extra financial security at low additional cost.

- Trusted Parent Company (Phoenix Group)

- Backed by one of the UK’s largest retirement and savings businesses.

- Strong financial stability ensures long-term protection.

📌 Why It Matters

For people who worry about being rejected because of age or health conditions, British Seniors provides peace of mind with guaranteed approval. Its quick claim payout and funeral support make it a practical solution for UK families who want certainty at an affordable cost.

👉 As MoneyHelper UK explains, guaranteed acceptance life insurance is often the easiest way for seniors to ensure their loved ones are financially supported after they’re gone.

Special Investment Region (SIR): The 2025 Complete Guide for Global Investors

Drawbacks & Limitations of British Seniors Life Insurance

While British Seniors Life Insurance provides simplicity and guaranteed acceptance, it isn’t the right choice for everyone. Like any over-50s plan, there are some important limitations to understand before applying.

❌ Key Drawbacks

- Smaller Payouts

- Maximum cover is usually £10,000, which may not be enough for families needing long-term financial protection (mortgages, income replacement, children’s education).

- Better suited for funeral costs and small debts.

- Premiums Can Outweigh Payout

- If you live a long life, it’s possible you may pay more in total premiums than the policy pays out.

- Common issue with over-50s life insurance across the UK market.

- Limited Age Range

- Only available for applicants aged 50–80.

- Not suitable for younger families or those who want large coverage at lower costs.

- Not the Cheapest Option

- Premiums are higher compared to term life insurance for healthy younger applicants.

- Competitors like SunLife or Legal & General may offer more competitive rates in certain cases.

- No Cash Value

- Policies do not build up savings or investment value.

- Strictly a protection product, not a wealth-building tool.

📌 Bottom Line

British Seniors Life Insurance is best viewed as a niche product: excellent for covering funeral expenses or leaving a small gift for loved ones, but not ideal for broader financial planning.

👉 As MoneySavingExpert highlights, over-50s plans are great for peace of mind, but comparing costs with regular life insurance policies is essential to avoid overpaying.

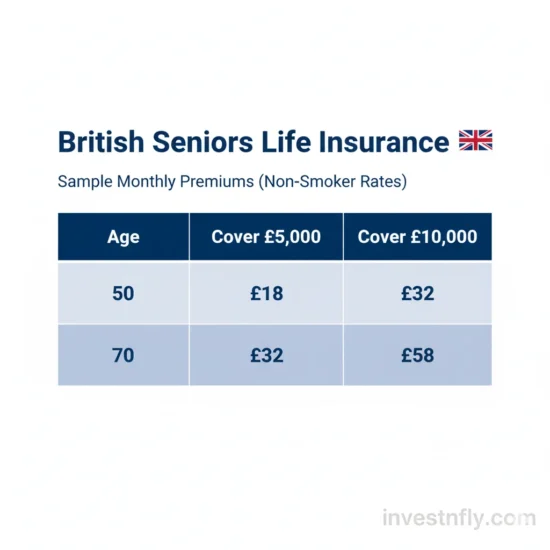

Rates & Cost Overview of British Seniors Life Insurance

When choosing life insurance, cost is always one of the most important factors. British Seniors Life Insurance keeps its pricing simple, but premiums vary based on age, smoking status, cover amount, and gender.

🔑 How Premiums Work

- Fixed for Life: Once you take out a policy, your monthly premium never increases.

- Age & Health: Younger non-smokers get the lowest premiums, while older smokers pay the most.

- Cover Range: Policies typically provide £1,000 to £10,000 in cover.

- No Medical Exam: Premiums are higher than term life, since guaranteed acceptance means greater risk for the insurer.

Sample Monthly Premium Estimates (Illustrative Only)

| Age (Non-Smoker) | £5,000 Cover | £10,000 Cover |

|---|---|---|

| 50 years old | £12 – £18 | £22 – £30 |

| 60 years old | £20 – £28 | £36 – £45 |

| 70 years old | £34 – £45 | £60 – £75 |

(Disclaimer: These figures are illustrative. Actual premiums vary by personal circumstances, smoking status, and insurer underwriting.)

📌 Key Insights

- For many seniors, £5,000–£10,000 is sufficient to cover funeral costs and small debts.

- Buying younger (at 50–55) locks in cheaper premiums and long-term savings.

- At older ages (70+), premiums rise sharply, making comparison shopping essential.

👉 According to MoneyHelper UK, over-50s plans are most effective for people who only need small, guaranteed cover, not full family income protection.

Pros & Cons of British Seniors Life Insurance

Every life insurance plan has strengths and weaknesses. British Seniors Life Insurance is no exception. By weighing the pros and cons, you can decide if this policy is right for you or if alternatives may fit better.

✅ Pros

- Guaranteed Acceptance: No medical exams, guaranteed cover for UK residents aged 50–80.

- Fixed Premiums: Your monthly payment never changes.

- Fast Payouts: Claims typically processed within 24–48 hours.

- Funeral Benefit Option: Up to £300 contribution when using Golden Charter.

- Trusted Parent Company: Backed by Phoenix Group, one of the UK’s largest insurers.

- Peace of Mind: Helps cover funeral costs and small debts, ensuring families aren’t left with unexpected bills.

❌ Cons

- Limited Payouts: Maximum £10,000 cover — not enough for larger financial protection.

- Premiums May Exceed Payout: Long-lived policyholders may pay in more than the benefit amount.

- Not the Cheapest Option: Younger, healthy buyers often get cheaper term policies elsewhere.

- Restricted Age Range: Only available for ages 50–80.

- No Cash Value: Strictly protection-only, no savings or investment element.

Quick Comparison Table

| Pros | Cons |

|---|---|

| Guaranteed acceptance (50–80) | Smaller payouts (£10,000 max) |

| Fixed premiums for life | Can pay more in premiums over time |

| Fast claims (24–48 hours) | Higher costs vs term insurance |

| Funeral benefit option (£300) | Limited to seniors, not younger families |

| Backed by Phoenix Group (trustworthy) | No cash value or wealth-building features |

👉 According to NerdWallet UK, over-50s policies like British Seniors are most useful for funeral planning, but less suitable for long-term family protection.

British Seniors Life Insurance vs Competitors

When shopping for over-50s life cover, it’s smart to compare multiple providers. While British Seniors Life Insurance offers simplicity and guaranteed acceptance, competitors like SunLife, Aviva, and Legal & General also have strong options. Here’s how they compare.

🔑 Key Competitors

1. SunLife Over 50s Plan

- Perhaps the most well-known brand in this niche.

- Guaranteed acceptance for 50–85-year-olds.

- Offers perks like a free welcome gift.

- Strong marketing presence, but premiums can be higher than competitors.

2. Aviva Life Insurance

- Offers a mix of over-50s cover and standard term life.

- Wider coverage amounts compared to British Seniors.

- Good option for families needing higher protection.

3. Legal & General Over 50s Life Insurance

- Coverage available up to age 80.

- Fixed monthly premiums with guaranteed acceptance.

- Reputable UK brand with strong financial history.

📊 Comparison Table

| Feature | British Seniors | SunLife | Aviva | Legal & General |

|---|---|---|---|---|

| Eligibility | Ages 50–80 | Ages 50–85 | Wider (standard cover) | Ages 50–80 |

| Cover Amounts | £1,000–£10,000 | £1,000–£18,000 | Higher, flexible | £1,000–£10,000 |

| Medical Exam | Not required | Not required | Sometimes required | Not required |

| Funeral Benefit | £300 (Golden Charter) | £250 (Co-op) | None | None |

| Payout Speed | 24–48 hours typical | Few days | Varies | Varies |

| Best For | Simple funeral cover | Brand trust + gifts | Families needing more | Reputable over-50s |

📌 Bottom Line

- British Seniors: Best for seniors seeking straightforward, guaranteed cover and quick claims.

- SunLife: More famous but often pricier.

- Aviva: Better for higher, long-term coverage.

- Legal & General: Reputable alternative with similar over-50s plans.

👉 As Forbes Advisor UK notes, comparing multiple providers is essential, since costs and features vary widely.

Who Should Consider British Seniors Life Insurance?

Not everyone in the UK will find British Seniors Life Insurance the right fit. The company focuses on a specific audience, and knowing whether you fall into that group can save time and money.

✅ Best Suited For

- Seniors Aged 50–80: Guaranteed acceptance makes it ideal for older applicants who may struggle with medical underwriting elsewhere.

- People with Health Concerns: No medical exams or lengthy health checks — approval is fast and stress-free.

- Families Planning for Funeral Costs: Cover amounts of £1,000–£10,000 are perfect for funeral expenses, outstanding bills, or leaving a modest gift.

- Those Seeking Simplicity: Straightforward policies with fixed monthly premiums help seniors budget confidently.

❌ Not Ideal For

- Younger Families: Coverage is too limited to replace income or pay off large debts.

- High Coverage Needs: Anyone looking for more than £10,000 protection will find better value with Aviva or other term life providers.

- Price-Sensitive Buyers: Premiums may not be the cheapest compared to broader term life insurance products.

📌 Bottom Line

British Seniors Life Insurance is designed for peace of mind, not wealth building. If your goal is to cover funeral costs or leave a small financial cushion for loved ones, it’s a practical, guaranteed option. For larger protection needs, exploring mainstream insurers is a smarter choice.

FAQs About British Seniors Life Insurance

❓ Is British Seniors Life Insurance a good company?

Yes. British Seniors is part of the Phoenix Group, one of the UK’s largest savings and retirement businesses. It is also authorized and regulated by the Financial Conduct Authority (FCA), giving customers confidence in its reliability.

❓ Do I need a medical exam to qualify?

No. All UK residents aged 50–80 are guaranteed acceptance without medical exams or health checks.

❓ How much cover can I get?

Policies typically range from £1,000 to £10,000, making them suitable for funeral costs, small debts, or leaving a modest gift.

❓ How quickly are claims paid?

Most claims are processed within 24–48 hours once the required documents are submitted.

❓ Can I cancel my policy?

Yes, policies usually include a 30-day cooling-off period. After that, you can cancel anytime, but premiums already paid are non-refundable.

❓ Is British Seniors the cheapest option?

Not always. While premiums are competitive for guaranteed acceptance cover, alternatives like SunLife or Legal & General may be cheaper depending on age and needs.

Conclusion

British Seniors Life Insurance has carved out a solid place in the UK market for over-50s cover. Backed by the Phoenix Group and regulated by the FCA, it provides peace of mind with guaranteed acceptance, fixed premiums, and quick claim payouts. For many seniors, the simplicity of knowing their family won’t face funeral costs or small debts is priceless.

That said, this isn’t a one-size-fits-all policy. The cover amount is limited (up to £10,000), and for some buyers, the total premiums over time could outweigh the payout. Younger families or those looking for larger protection may find better value with insurers like Aviva or Legal & General.

👉 If your goal is affordable, guaranteed life cover without medical exams, British Seniors is worth strong consideration. But before deciding, compare at least two or three providers to make sure you’re getting the best deal for your situation.

✅ Take the next step: Get a free quote today from British Seniors or compare alternatives — your family’s peace of mind is worth it.