Introduction

Driveaway insurance is a short-term policy that protects you when driving a newly purchased or transported vehicle. Unlike traditional car insurance which usually lasts 6–12 months, driveaway coverage can last from just a few hours up to two weeks. For anyone buying a car, collecting a vehicle from a dealer, or moving it across states, this coverage is often essential.

Understanding how much it costs is important because prices vary by state, provider, and vehicle type. In 2025, short-term insurance remains an affordable way to stay legal while driving your car home.

👉 For a complete overview of coverage types and who needs them, see our main guide: Driveaway Insurance in USA 2025.

Average cost of driveaway insurance in the USA

On average, driveaway insurance costs $30 to $80 per day. If you need coverage for a week, expect to pay $150 to $400, while two-week policies usually cost between $280 and $650. For professional drivers moving cars for dealerships, per-trip policies are common, ranging from $300 to $600.

| Duration | Economy Car | Standard Sedan | SUV/Truck | Luxury Vehicle |

|---|---|---|---|---|

| 1 Day | $30–$40 | $40–$50 | $50–$65 | $70–$80 |

| 7 Days | $150–$200 | $180–$250 | $220–$300 | $300–$400 |

| 14 Days | $280–$350 | $320–$420 | $380–$500 | $500–$650 |

These figures are market estimates. Actual quotes depend on your driving history, location, and provider. To compare different insurers, see Best Driveaway Insurance Providers.

Factors that influence the cost

Several elements determine the cost of driveaway insurance:

- Vehicle type and value: Luxury cars and SUVs cost more than small sedans or economy cars. Repairs and theft risk push rates higher.

- Coverage duration: A 1-day policy looks cheap, but per-day cost is higher than 7-day or 14-day policies.

- Driver profile: A 22-year-old new driver often pays 20–30% more than someone aged 40 with a clean record.

- State requirements: California, New York, and Michigan demand higher liability coverage, raising costs. States like Ohio or Arizona are usually cheaper.

- Provider differences: Dealers often add hidden fees, while online providers compete on lower prices.

According to the Insurance Information Institute, state liability rules are one of the biggest reasons prices vary across the country.

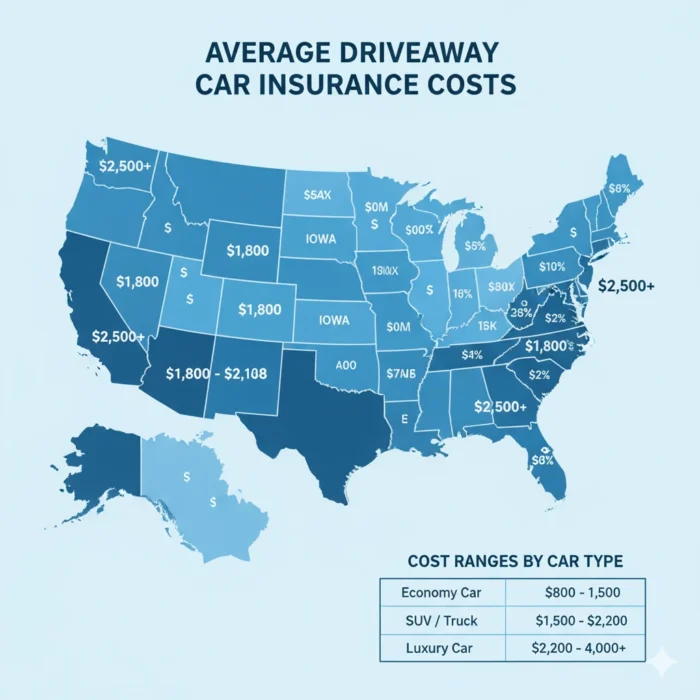

Driveaway insurance cost by state

Weekly cost for a standard sedan in 2025 can vary by more than $100 depending on where you live.

| State | Average Weekly Cost | Notes |

|---|---|---|

| California | $220–$280 | High liability required |

| Texas | $180–$240 | Dealer coverage common |

| New York | $250–$320 | DMV requires proof before plates |

| Florida | $260–$350 | High accident rates |

| Illinois | $190–$250 | Moderate pricing |

| Michigan | $270–$350 | No-fault laws increase cost |

| Ohio | $180–$230 | Affordable, lower accident rates |

| Arizona | $200–$260 | Popular for interstate buyers |

| Washington | $210–$280 | Rising gradually in 2025 |

| Pennsylvania | $200–$270 | Balanced but stricter liability |

| New Jersey | $230–$300 | Dense traffic raises risk |

| Colorado | $190–$260 | Popular for interstate trips |

👉 For detailed rules, always check your local DMV website. For example, the California DMV clearly outlines proof of insurance requirements.

Provider-specific cost ranges

Different insurers target different audiences. Here are typical 2025 price ranges:

- Tempcover – $35–$75/day. Best for individual buyers who need quick coverage at the dealership.

- Cuvva – $30–$70/day. Flexible hourly and daily policies through an app. Popular with younger drivers.

- Surefire – $40–$80/day. Suited for dealers and commercial fleets.

- GoShorty – $25–$60/day. Budget-friendly and expanding from the UK to the US.

- IRMI – $300–$600/job. Designed for transport companies with higher liability needs.

👉 For full details, see Best Driveaway Insurance Providers.

Temporary vs dealer coverage costs

A common question is: “Should I take insurance from the dealer or buy it online?”

- Dealer coverage is convenient but often more expensive because it’s bundled with fees.

- Online temporary policies are usually cheaper and give more flexibility.

| Type | 1 Day | 7 Days | 14 Days | Key Difference |

|---|---|---|---|---|

| Temporary (Online) | $30–$70 | $180–$300 | $320–$500 | Flexible, quick purchase |

| Dealer Policy | $50–$90 | $220–$350 | $400–$650 | Often includes dealer extras |

For a deeper analysis, check Temporary Driveaway Insurance vs Dealer Coverage.

Tips to save money on driveaway insurance

- Compare quotes: At least 2–3 providers before deciding.

- Pick the exact duration: If you only need 1 day, don’t pay for a week.

- Avoid luxury vehicles: Temporary coverage scales with car value.

- Book in advance: Some providers let you lock in rates.

- Upgrade smartly: A few insurers let you convert to annual policies at discounts.

Example scenarios

- A 22-year-old in Texas buying a used sedan might pay $240 for a week.

- A 45-year-old in Ohio with a clean record may pay closer to $180 for the same policy.

- A Florida driver buying a luxury SUV may see $350+ weekly costs due to higher accident risk.

- A transporter moving vehicles from California to Florida may pay $500–$600 per trip.

External resources

- Insurance Information Institute (III) – statistics on auto insurance costs

- California DMV – state liability requirements

- National Association of Insurance Commissioners (NAIC) – regulatory guidance

FAQs About Driveaway Insurance Cost in USA

Q1. Why does driveaway insurance cost more per day than annual car insurance?

Because short-term policies cover only a few days, the insurer spreads admin and risk costs into a smaller period, making the per-day price higher.

Q2. Is one-day driveaway insurance worth it if I only need to drive home from the dealership?

Yes. A one-day policy may cost $30–$80, but it ensures you are legally covered and avoids heavy fines for driving without insurance.

Q3. Do luxury cars always have higher driveaway insurance costs?

Yes. Insurers charge more for luxury or high-value cars because repairs, theft risk, and liability claims are more expensive.

Q4. Which states have the cheapest driveaway insurance cost?

In 2025, Ohio, Texas, and Arizona are among the cheapest states, while Michigan, New York, and Florida are more expensive due to liability requirements and accident rates.

Q5. Can I reduce costs by comparing providers online?

Absolutely. Comparing just two or three online providers can save 20–30% compared to dealer-offered coverage.

Conclusion

Driveaway insurance cost in the USA costs $30–$80 per day and is a smart, legal way to protect yourself while driving a car home from a dealer or across state lines. Weekly and two-week plans are cheaper per day, and transporter policies are available for commercial needs.

Dealer coverage is convenient but usually costs more than temporary online providers. The smart move is to compare quotes, check your state’s rules, and only buy coverage for the time you need.

👉 Next, explore related guides: