Introduction

Fuel expenses are one of the biggest challenges for small businesses, trucking companies, and delivery services in the USA. While traditional fuel cards are useful for tracking expenses and saving money, many providers require a credit check. This makes it difficult for startups and businesses with limited or poor credit history to get approval.

That’s where fuel cards for business with no credit check come in. These prepaid or secured cards allow companies to manage fuel expenses without worrying about credit approvals. In this guide, we’ll explore the best options, their benefits, and how to choose the right one for your business.

👉 According to a Forbes Advisor report, fuel cards not only simplify expense tracking but also help businesses manage cash flow efficiently.

What Are Fuel Cards for Business?

A fuel card for business is a payment solution designed specifically for fuel and vehicle-related expenses. Instead of giving drivers cash or asking them to use personal credit cards, companies issue fuel cards that are accepted at thousands of gas stations across the USA.

These cards work just like regular payment cards but come with extra controls and features tailored for business needs:

🔑 Key Features of Business Fuel Cards

- Fuel-only restriction: Can be used only at gas stations or service stations, preventing misuse on non-business purchases.

- Expense tracking: Every transaction is recorded digitally, making it easy to review spending by driver, date, or vehicle.

- Spending limits: Business owners can set daily, weekly, or monthly limits to control cash flow.

- Online dashboard: Most providers offer apps or portals to generate reports, useful for tax filing and accounting.

- Discounts & rewards: Some cards offer fuel rebates, loyalty rewards, or lower per-gallon costs.

📈 Why Businesses Prefer Fuel Cards

- Saves time compared to handling receipts or reimbursements.

- Helps prevent fraud or unauthorized spending.

- Reduces administrative work for finance teams.

- Offers better visibility into fleet or driver fuel usage.

For small businesses and startups in the USA, one of the biggest barriers to getting a traditional fuel card is the credit check requirement. Many providers want strong business credit history before approval. But new companies, or those with bad credit, often struggle here.

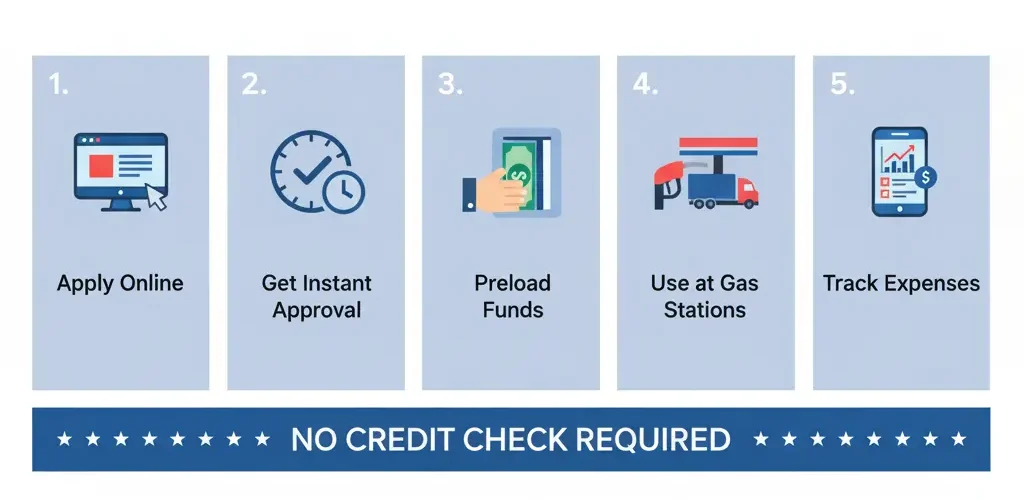

That’s why fuel cards for business with no credit check are becoming popular. These are usually prepaid or secured cards: businesses load money upfront, and employees use it like a regular fuel card — no credit history needed.

👉 According to NerdWallet’s guide on business gas cards, prepaid and fuel-only cards are ideal for small companies that want simple approval without the risks of traditional credit.

Best Credit Union Business Credit Cards in 2025 – Features, Benefits & How to Apply

Why No Credit Check Matters

For many small businesses in the USA, credit history becomes the biggest barrier when applying for fuel cards. Traditional providers often run business and even personal credit checks before approval. If your company is new or your credit score is low, chances are your application will be denied.

This is where fuel cards for business with no credit check play a vital role. They allow startups, small fleets, and even gig economy drivers to access the same benefits without worrying about rejection.

🚧 Common Credit Challenges for Businesses

- Startups: Most new businesses have no established credit profile.

- Bad credit history: Missed payments or debt issues can reduce approval chances.

- Personal guarantee risks: Many cards ask owners to put personal credit on the line.

- Time-consuming approvals: Traditional cards may take weeks for review and verification.

✅ How No Credit Check Fuel Cards Solve These Issues

- Instant Approval: Prepaid or secured cards approve businesses quickly, often within minutes.

- No Risk to Personal Credit: Since they don’t require credit history, your personal score stays unaffected.

- Cash Flow Control: You load funds in advance, so you never overspend.

- Access for Everyone: Even small courier businesses or local contractors can qualify.

For example, the Small Business Administration (SBA) notes that limited access to financing is one of the top challenges faced by new businesses in the US. By using no-credit-check fuel cards, these companies can still manage operations efficiently without relying on traditional credit systems.

📊 Real-World Use Cases

- A startup trucking company with 5 vehicles gets instant access to prepaid fuel cards and avoids cash reimbursements.

- A local delivery service struggling with poor credit history uses no-credit-check fuel cards to keep drivers on the road.

- A construction contractor manages multiple vehicles by setting fuel limits per driver, without needing credit approval.

In short, no credit check fuel cards break down financial barriers, giving small and growing businesses the tools to manage expenses, track fuel usage, and keep operations running smoothly.

Buy Now Pay Later Cars (2025): Drive Today, Pay Later – Easy Financing Guide

Best Fuel Cards for Businesses with No Credit Check in the USA

Not all fuel cards in the USA require strong credit history. Some providers offer prepaid, secured, or no-credit-check options designed for small businesses and startups. Here are a few of the most popular choices:

1. Shell Fleet Prepaid Card

- Type: Prepaid (No credit check)

- Coverage: 12,000+ Shell stations nationwide

- Features: Load funds in advance, track spending, online portal

- Pros: Wide coverage, easy approval, digital reporting

- Cons: Can only be used at Shell stations

2. WEX FlexCard (Prepaid Version)

- Type: Prepaid business fuel card

- Coverage: Accepted at 95% of US gas stations

- Features: Set spending limits per driver, detailed expense reports

- Pros: Universal acceptance, flexible spending controls

- Cons: Must preload balance; no credit building

3. ExxonMobil Business Fleet Card (Secured Option)

- Type: Secured / deposit-based

- Coverage: 11,500+ Exxon & Mobil stations

- Features: Detailed fuel usage reports, fraud monitoring

- Pros: Helps establish business credit if upgraded later

- Cons: Limited station coverage compared to WEX

📊 Comparison Table

| Card Name | Type | Coverage | Pros | Cons |

|---|---|---|---|---|

| Shell Fleet Prepaid Card | Prepaid | 12,000+ Shell stations | Easy approval, wide coverage | Limited to Shell stations |

| WEX FlexCard Prepaid | Prepaid | 95% of US gas stations | Universal acceptance, spending controls | Requires prepaid balance |

| ExxonMobil Fleet Secured | Secured | 11,500+ Exxon & Mobil | Detailed reports, potential to build credit | Limited coverage, deposit needed |

Pro Tip

If your business is just starting out, prepaid fuel cards are the safest choice. As your company grows, you can upgrade to secured or credit-based fuel cards that may offer rewards or rebates.

According to Investopedia, prepaid fuel cards are an excellent way for small businesses to manage expenses without taking on credit risk.

How to Choose the Right Fuel Card

With multiple options available in the USA, choosing the best fuel card for business with no credit check depends on your company’s size, fleet type, and spending habits. Instead of just picking the first option, consider the following factors:

🔎 Key Factors to Consider

- Coverage Area

- Does the card work at most gas stations nationwide or is it tied to one brand (e.g., Shell, Exxon)?

- Universal cards like WEX are better for fleets traveling across states.

- Fees & Charges

- Check for monthly maintenance fees, transaction fees, or hidden charges.

- Some prepaid cards have no annual fee, making them cost-effective for small fleets.

- Spending Controls

- Can you set purchase limits by driver or vehicle?

- Helps avoid fuel misuse or unnecessary spending.

- Reporting & Tracking

- Good cards provide online dashboards with expense reports.

- This helps in tax filing, reimbursement, and identifying fuel theft.

- Discounts & Rewards

- Some cards offer rebates (e.g., 5¢ per gallon savings).

- Check whether savings apply nationwide or only at certain stations.

- Flexibility of Payment

- Prepaid cards are safer for startups.

- Secured cards may help build business credit over time.

📊 Infographic Style: Steps to Pick the Right Fuel Card

1️⃣ Analyze your business fuel needs

2️⃣ Compare prepaid vs. secured card options

3️⃣ Review fees & coverage area

4️⃣ Check reporting features for expense tracking

5️⃣ Choose the card that matches your business growth stage

👉 According to Bankrate’s small business fuel card guide, companies that evaluate fees, station coverage, and tracking tools save significantly more on operational costs.

Traceloans.com Business Loans (2025) – Reviews, Features & Best Alternatives

Pros & Cons of No Credit Check Fuel Cards

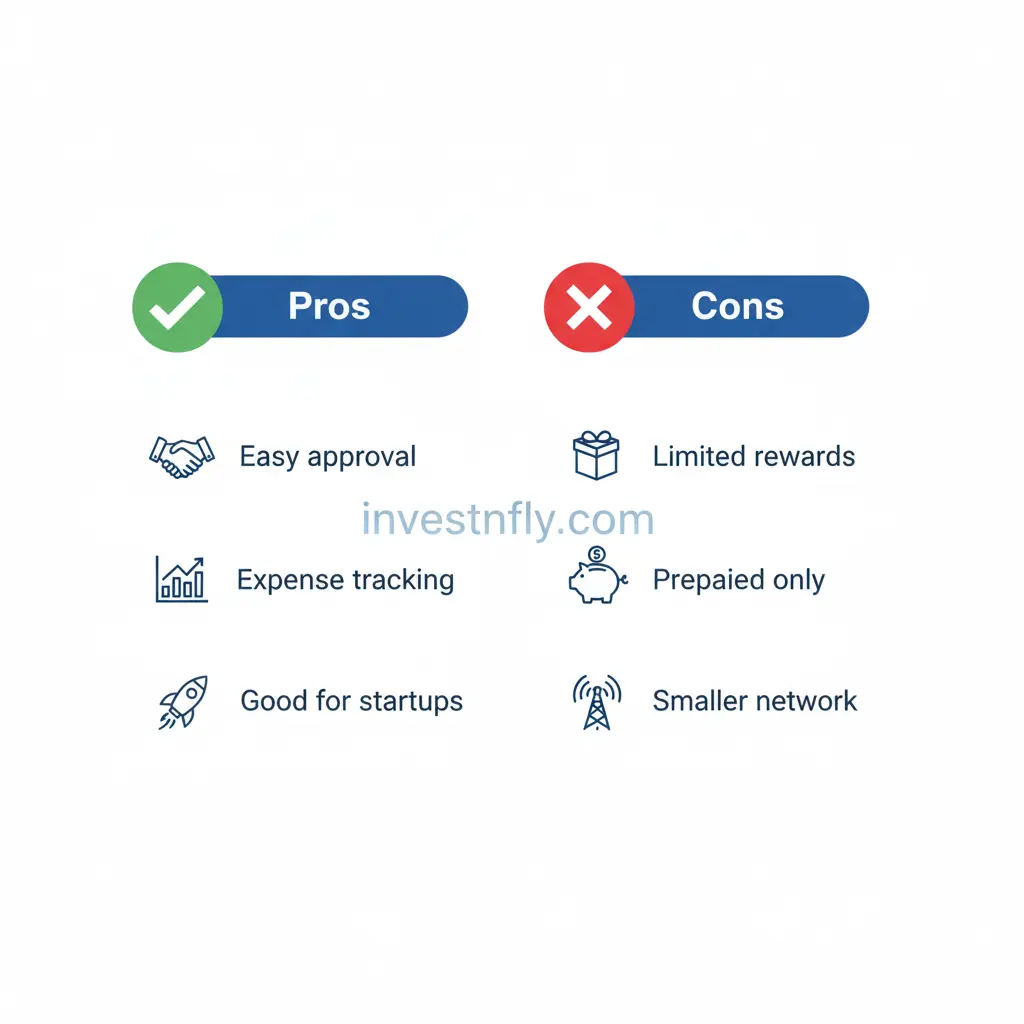

Like any financial tool, fuel cards for business with no credit check come with both advantages and limitations. Understanding these will help you decide whether they are the right fit for your company.

✅ Pros

- Easy Approval: No credit history required, great for startups and small businesses.

- Instant Access: Many providers approve applications within minutes.

- Expense Tracking: Digital reports simplify bookkeeping and tax filing.

- Cash Flow Control: Prepaid structure prevents overspending.

- Accessibility: Available to businesses with poor or no credit score.

❌ Cons

- Limited Rewards: Unlike traditional credit fuel cards, prepaid options rarely offer big cashback or rebates.

- Upfront Payments: You need to load funds in advance, which may strain cash flow.

- Restricted Coverage: Some cards are tied to specific gas station networks.

- No Credit Building: Prepaid cards usually don’t improve business credit (unless upgraded later).

Bad Credit Motorbike Loans – Easy Approval Options for Poor Credit

FAQs

❓ Can I get a fuel card for my business with bad credit?

Yes. Many prepaid and no credit check fuel cards are available in the USA that do not require a strong credit history. They are designed for startups and small businesses.

❓ Do fuel cards with no credit check help build business credit?

Most prepaid cards do not directly build credit. However, some secured cards (deposit-based) may report to credit bureaus once upgraded to credit-based plans.

❓ Are prepaid fuel cards tax-deductible?

Yes. Fuel expenses paid through business fuel cards are generally tax-deductible if they are legitimate business costs. Always keep digital records for tax filing.

❓ Which is better: prepaid or secured fuel cards?

- Prepaid: Best for startups and businesses with poor/no credit.

- Secured: Good if you want to build business credit gradually.

❓ Do no credit check fuel cards have nationwide acceptance?

It depends on the provider. Some (like WEX) are accepted at 95% of gas stations in the USA, while brand-specific cards (like Shell) work only at their stations.

Conclusion

Managing fuel expenses is one of the biggest challenges for small businesses, startups, and fleets in the USA. Traditional fuel cards often create roadblocks with strict credit check requirements, but prepaid and secured fuel cards for business with no credit check make expense management simple and accessible.

Whether you’re a delivery service, trucking company, or contractor, these cards give you the flexibility to track spending, control fuel costs, and keep your vehicles on the road without financial stress.

👉 Now is the best time to explore no credit check fuel card options for your business and take the first step toward smarter, more efficient fuel management.