A practical, in-depth guide explaining what Special Investment Regions are, how they operate, why they matter to investors and governments, and how to evaluate opportunities in 2025 and beyond.

What is a Special Investment Region (SIR)?

A Special Investment Region (SIR) is a large, planned geographic area built specifically to attract investment by combining industrial capacity, urban infrastructure, and investor-friendly policies. Unlike small-scale industrial parks or single-purpose Special Economic Zones (SEZs), SIRs are multi-sector, multi-use developments that include manufacturing clusters, logistics hubs, commercial real estate, and residential neighborhoods — all coordinated under a single governance framework.

SIRs typically feature:

- Large land parcels (often 100+ km²),

- Integrated transport links (ports, highways, airports),

- Advanced utilities and digital infrastructure, and

- Policy incentives such as single-window approvals and tax breaks.

Origins & Global Context OF special investment region

The idea of clustered economic zones evolved gradually. Countries experimented with export zones, free ports, and industrial parks during the late 20th century. The model matured into modern SIRs as governments sought more holistic development: urban planning plus industrial capacity.

Notable predecessors and influences include:

- Shenzhen (China): from SEZ origins to a global megacity;

- Songdo (South Korea): built as a smart city with international business features;

- Dubai Investment Park / Jebel Ali (UAE): mixed-use, logistics-oriented hubs.

In 2025 the SIR concept is global — adopted as a development strategy in Asia, the Middle East, parts of Latin America and selective US states that promote targeted investment corridors and opportunity zones.

Objectives of Special Investment Regions

Governments and regional planners create SIRs with explicit goals:

- Attract FDI: offering incentives and infrastructure that multinational companies need to set up operations quickly;

- Generate employment: both direct manufacturing/service jobs and indirect roles through supply chains;

- Build export capacity: integrate producers into global value chains;

- Plan urban growth: create livable cities rather than ad-hoc industrial districts;

- Support clusters & innovation: co-locate R&D, suppliers, and talent.

Key Features & Governance

The practical success of an SIR depends on three pillars: governance, infrastructure, and policy incentives.

Governance

SIRs are usually overseen by a dedicated development authority (SIRDA style entity) empowered to manage land allocation, permits, and public services. This single-window governance reduces bureaucratic friction and shortens time-to-market for projects.

Infrastructure

Infrastructure in an SIR is comprehensive: expressways, dedicated freight lines, port links, utility microgrids, water treatment plants, and high-capacity digital networks. Increasingly, SIR planners include renewable energy parks and resilience measures (flood control, waste management).

Policy Incentives

Common incentives include tax breaks, customs facilitations, subsidized land leases, and fast-track environmental and building clearances. Investors value predictability — clear, codified incentive packages outperform ad-hoc concessions.

SIR vs SEZ vs Industrial Corridor — Quick Comparison

Understanding differences helps select the right project type:

| Feature | SIR | SEZ | Industrial Corridor |

|---|---|---|---|

| Scale | Very large (100+ km²) | Smaller zones | Linear transport-focused |

| Focus | Multi-sector urban + industry | Export manufacturing | Logistics & industry |

| Governance | Dedicated development authority | SEZ authority | Corridor corp / multi-agency |

Economic Impact & Data (what investors watch)

Well-executed SIRs can shift regional growth trajectories. Key metrics investors and policymakers track include:

- FDI inflows and project commitments (USD);

- Number of operational manufacturing units and export value;

- Direct and indirect employment created;

- Infrastructure uptime (power, water reliability);

- Ease-of-doing-business indicators and average permitting timelines.

Multilateral analyses (World Bank, OECD, UNCTAD) suggest integrated hubs deliver higher productivity per worker and faster export growth than scattered industrial estates. For reference and deeper study, see the World Bank and UNCTAD investment reports.

Global Case Studies On special investment region(selected examples)

Examining real SIR-like projects helps illustrate their variety and potential.

Dholera Special Investment Region — India

Dholera SIR (Gujarat) is an ambitious greenfield project with a planned airport, ports connectivity, and smart-city infrastructure. Designed to host manufacturing — including electronics and EV components — Dholera is often cited as a model of state-led, large-scale planning. While India-specific, the lessons from Dholera (phased development, public-private participation, land pooling) offer transferable insights for global investors.

Shenzhen special investment region — China (evolved model)

Shenzhen began as an SEZ but scaled into a full megacity and global manufacturing and innovation hub. Its growth demonstrates how policy certainty, cluster formation, and investment in skills can accelerate regional transformation.

Songdo special investment region — South Korea

Built as a planned smart city, Songdo highlights technology integration (IoT, green buildings) and the potential for knowledge-intensive investment close to global transport links.

Dubai Investment Park / Jebel Ali — UAE

A mixed-use model that combines logistics, manufacturing, and residential amenities. The UAE example underscores the importance of connectivity (air and sea), regulatory clarity, and international business services as SIR enablers.

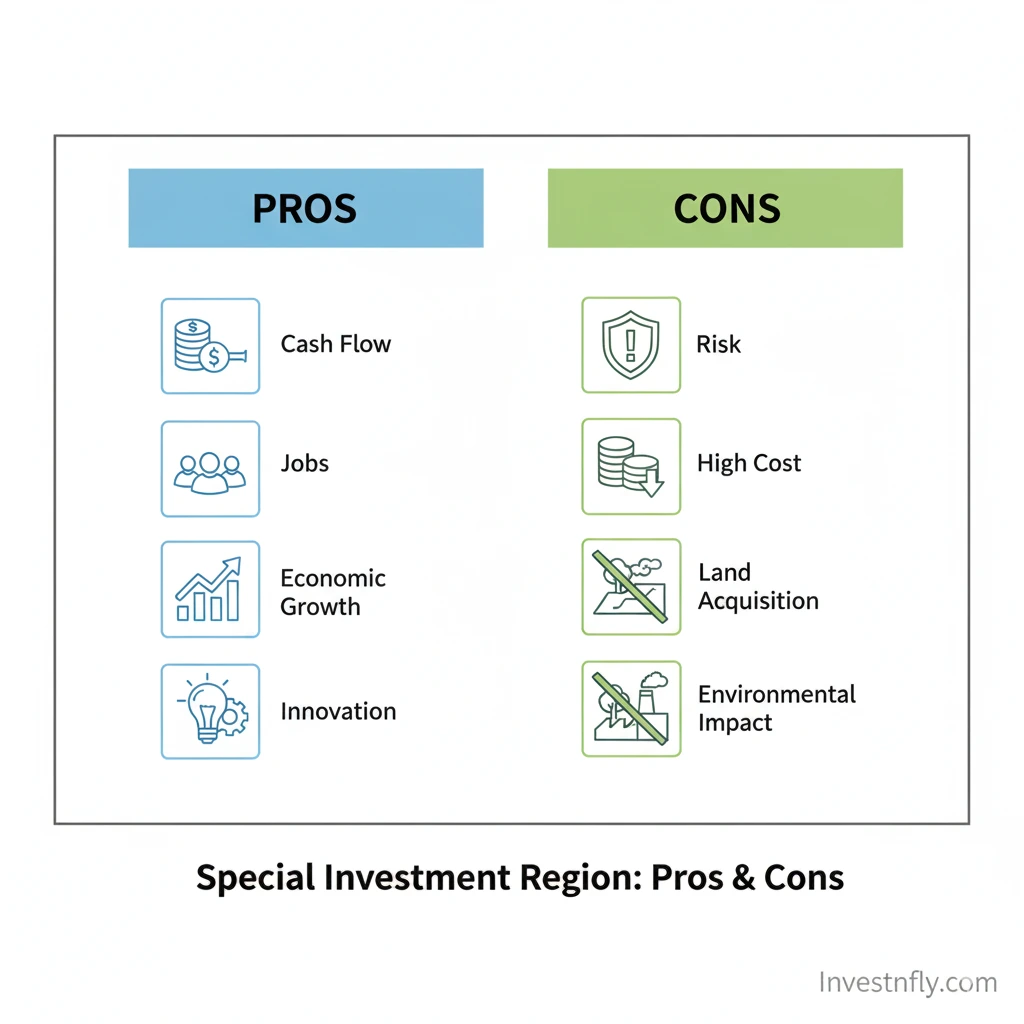

Challenges & Risks

SIRs offer opportunity, but investors must manage risks:

- High upfront costs: infrastructure and land development require sizable capital.

- Land acquisition & social issues: fair compensation and resettlement are politically sensitive.

- Regulatory change risk: investor-friendly policies must be durable across political cycles.

- Environmental footprint: large projects must meet sustainability standards or face opposition.

- Competition: multiple countries chase similar investors — quality of infra and governance matters most.

How Investors Should Evaluate an SIR

When assessing a Special Investment Region opportunity, use this practical checklist:

- Governance & approvals: Is there a single development authority? What are permitting timelines?

- Connectivity: How close are ports, airports, and expressways? Freight cost matters.

- Utilities reliability: power, water, effluent treatment, and renewable sources.

- Labor & skills: availability of skilled workforce or proximity to training institutions.

- Cost of land & lease terms: freehold vs long-term lease; phased payment options?

- Incentives & tax regime: clarity on tax holidays, customs, and subsidies.

- Environmental compliance: sustainability targets, carbon rules, and local limits.

- Exit options: resale market, secondary buyers, and developer guarantees.

Practical Steps to Invest in a Special Investment Region

For a company or investor ready to enter an SIR, follow a phased approach:

Phase 1 — Feasibility & Due Diligence

Conduct market & demand studies, transport cost analysis, and legal due diligence. Validate regulatory incentives via official channels and inspect developer track record.

Phase 2 — Site Selection & Financial Modelling

Select land parcels based on logistics, workforce, and utilities. Model capex/opex, tax impact, and project IRR under conservative assumptions.

Phase 3 — Approvals & Build

Use single-window systems where available to obtain permits. Negotiate phased infrastructure delivery and service-level agreements with the authority.

Phase 4 — Operations & Scale

After commissioning, focus on supply-chain integration, workforce development, and sustainability KPIs (energy use, waste diversion).

Internal & External Resources

Useful Investnfly internal links (contextual placement suggestions):

- High Yield Savings Accounts 2025 — Benefits — for short-term parking of investment capital and liquidity planning.

- BHG Financial Debt Consolidation Loan — Guide — for corporate financial restructuring prior to large investments.

- Merrimack Valley Credit Union — Online Banking & Services — for digital banking examples and cross-border finance facilitation.

- FNBHebb Online Banking Login — Guide — for examples of efficient online banking services investors may require.

Authoritative external references:

- World Bank — research on zones, investment policy, and urban development.

- OECD Investment Policy — analysis of investment incentives and best practices.

- UNCTAD — World Investment Reports and global FDI data.

- A.M. Best — insurer financial strength checks (relevant for insurance & risk transfer).

- NAIC — for regulatory and consumer protection references in insurance when evaluating risks.

Frequently Asked Questions

Q1. What exactly is a Special Investment Region?

A Special Investment Region is a large, planned area combining industry, living, and commercial infrastructure with investor-friendly policies and streamlined governance to attract major investment.

Q2. How does an SIR differ from an SEZ?

SEZs are typically smaller and export-focused; SIRs are larger, multi-sector, and designed as integrated urban-industrial regions.

Q3. Are SIRs only for big corporations?

No — while they attract large projects, well-designed SIRs include plots and facilities for SMEs, logistics firms, and service providers.

Q4. What are the key risks of investing in an SIR?

Risks include land-acquisition disputes, policy changes, environmental constraints, and infrastructure delivery delays. Thorough due diligence mitigates many of these risks.

Q5. Can foreign investors buy land inside SIRs?

Rules vary by country and region. Many SIRs use long-term leases rather than freehold sales to address regulatory constraints on foreign land ownership.

Q6. How should a company begin due diligence?

Start with governance review, land titles, infrastructure delivery timelines, and local labor supply assessments. Engage local legal counsel and technical due-diligence teams.

Q7. Do SIRs guarantee faster permits?

Good SIRs provide single-window or fast-track clearances, but guarantees depend on the legal framework and political commitment.

Q8. Are environmental regulations relaxed in SIRs?

No — while some processes are streamlined, robust SIRs enforce environmental standards and often build green infrastructure (renewables, waste treatment) into plans.

Q9. How do SIRs affect local economies?

Positively, through jobs and infrastructure. But they can also create local pressures (housing costs, resource use) if not managed with integrated planning.

Q10. What sectors are best suited for SIRs in 2025?

Manufacturing (EVs, electronics), logistics, data centers, renewable energy manufacturing, pharmaceuticals, and advanced materials — all attractive due to supply-chain clustering benefits.

Conclusion

Special Investment Regions are a strategic instrument for modern economic development. They deliver scale, integrated planning, and investor conveniences that small industrial parks cannot match. For investors, governments and companies preparing to expand internationally, SIRs present a long-term opportunity — provided governance, environmental standards, and infrastructure delivery are credible.

If you are evaluating an SIR opportunity, combine careful due diligence with local partnerships and a long-term view on sustainability. Use the internal resources listed above for financial planning and the external links for data-driven policy context.