Introduction to Temporary vs Dealer Driveaway Insurance

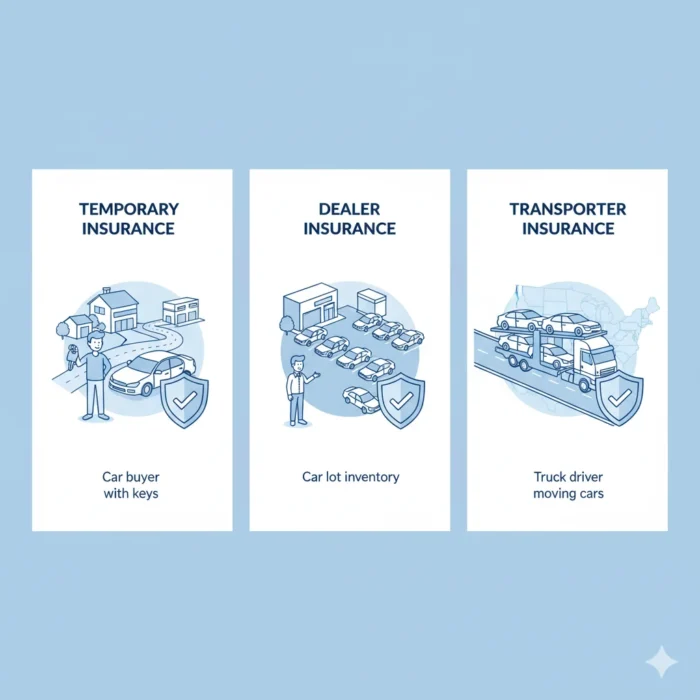

Buying a new or used car is exciting, but it also brings one important question — how do you insure the vehicle before you even drive it off the lot? This is where buyers often face two choices: purchasing temporary driveaway insurance from an independent provider or accepting the coverage offered directly by the dealer.

Both options serve the same purpose — keeping you legal on the road until long-term insurance begins. But the cost, flexibility, and level of protection can be very different. Temporary driveaway policies are short-term plans sold online or through apps, while dealer coverage is usually offered at the point of purchase and bundled with paperwork.

For new car buyers, fleet managers, or even transporters moving vehicles across states, understanding the difference between these two options can save hundreds of dollars and prevent legal trouble. This article compares both approaches in detail so you can make an informed decision.

👉 For a complete overview of coverage and nationwide costs, check the main guide: Driveaway Insurance in USA 2025.

What is Temporary Driveaway Insurance?

Temporary driveaway insurance is a short-term auto policy designed to cover drivers when they need protection for a limited time — usually from one day up to two weeks. Instead of committing to a full 6–12 month car insurance policy, drivers can buy coverage for just the duration they need.

Typical scenarios include:

- Driving a newly purchased car home from the dealership

- Collecting a used vehicle bought at auction

- Moving a car between states before permanent insurance starts

- Borrowing or transporting vehicles on behalf of someone else

Temporary coverage is popular because of its flexibility and instant availability. Most providers allow you to purchase it online within minutes and even schedule the exact start time. This is helpful for buyers who want their policy to begin the moment they collect the vehicle.

Cost and coverage basics

- Daily cost: $30–$80 depending on vehicle type

- Weekly policies: $150–$400

- Usually includes liability coverage, with optional add-ons for theft, fire, or collision damage

- Works in multiple states if issued by a national provider

Example: Imagine you buy a car in Arizona but live in Colorado. Instead of waiting for your permanent insurer to activate coverage, you purchase a 7-day temporary policy for $200. This allows you to legally and safely drive the car across state lines without worrying about fines or liability.

👉 To see how pricing works in more detail, visit Driveaway Insurance Cost in USA.

What is Dealer Driveaway Insurance?

Dealer driveaway insurance is coverage offered directly by car dealerships. Instead of purchasing online, buyers accept the dealer’s package, usually bundled into paperwork during the sale.

How it works:

- Dealer offers short-term coverage valid for 1–14 days

- Often bundled with fees or registration services

- Proof of insurance is immediate, so buyers can drive off the lot legally

Advantages:

- Extremely convenient at the point of sale

- No need to shop around or compare quotes

- Dealer handles all paperwork

Disadvantages:

- Costs are usually higher (20–30% more than online policies)

- Limited flexibility in coverage duration

- May include hidden fees

Example: A buyer in New York accepts dealer coverage while purchasing a new SUV. It costs $90 for one day or $320 for a week, compared to $65 online. The dealer handles DMV proof but the buyer pays more.

👉 For more details on providers, visit: Best Driveaway Insurance Providers.

Cost Comparison: Temporary vs Dealer Driveaway Insurance

| Type | 1 Day | 7 Days | 14 Days | Key Notes |

|---|---|---|---|---|

| Temporary (Online) | $30–$70 | $180–$300 | $320–$500 | Flexible, instant purchase |

| Dealer Policy | $50–$90 | $220–$350 | $400–$650 | Bundled, usually pricier |

In 2025, temporary coverage remains more affordable. Dealers charge more but may add DMV handling or convenience fees.

👉 For state-specific averages, see: Driveaway Insurance Cost in USA.

Coverage Differences

- Temporary Coverage: Liability as standard, with options for collision, fire, and theft. Works in multiple states. Ideal for quick trips or interstate drives.

- Dealer Coverage: Basic liability included, sometimes collision. Limited to dealer’s network or state. Less flexible for cross-state transport.

According to the Insurance Information Institute, liability rules differ by state, so checking whether your policy works across states is essential.

Pros and Cons of Temporary vs Dealer Driveaway Insurance

| Aspect | Temporary Coverage | Dealer Coverage |

|---|---|---|

| Cost | Lower ($30–$70/day) | Higher ($50–$90/day) |

| Flexibility | Buy anytime online | Limited to dealer’s package |

| Coverage Start | Customizable start time | Begins immediately at purchase |

| Paperwork | Digital, instant proof | Dealer handles all paperwork |

| Best For | Buyers needing short-term, interstate driving | Buyers who want convenience without research |

Which Option is Best for New Car Buyers?

For most new car buyers, temporary coverage is the smarter choice. It is cheaper, works across states, and can be extended or converted into a long-term policy later. Dealer coverage is convenient but often overpriced.

👉 For detailed buyer-focused insights, check: Driveaway Insurance for New Car Buyers.

Which Option is Best for Dealers & Transporters?

Dealers and transporters moving multiple vehicles may prefer dealer-linked policies or specialized fleet coverage. While temporary policies are useful for one-off deliveries, businesses often negotiate with insurers for bulk rates.

👉 For commercial providers, see: Best Driveaway Insurance Providers.

Tips for Choosing Between Temporary & Dealer Coverage

- Compare at least 2–3 providers before deciding

- Buy only the coverage duration you need

- Avoid assuming dealer coverage is cheapest

- Always confirm your policy is valid across state lines

- If possible, arrange temporary coverage in advance for lower rates

External tip: The National Association of Insurance Commissioners recommends verifying that any policy you buy is licensed in your state.

FAQs About Temporary vs Dealer Driveaway Insurance

Q1. Is dealer-provided insurance mandatory when buying a car?

No. You can refuse dealer coverage and arrange temporary insurance yourself.

Q2. Can I switch from dealer coverage to temporary insurance?

Yes. Most states allow you to cancel dealer policies and switch, but check cancellation rules.

Q3. Does temporary driveaway insurance work across all states?

Yes, if purchased from a nationwide provider. Always confirm coverage area before buying.

Q4. Which option is cheaper for one-day coverage?

Temporary policies are usually $30–$70, while dealer policies are $50–$90 for the same period.

Q5. Do transporters use temporary or dealer coverage?

Professional transporters usually use specialized fleet or transporter insurance, but one-off jobs may be covered by temporary policies.

External Resources

Insurance Information Institute (III)

👉 https://www.iii.org

- Reliable US insurance stats & explanations.

- Use in coverage differences / liability rules.

National Association of Insurance Commissioners (NAIC)

👉 https://content.naic.org

- Explains regulatory requirements for insurers.

- Use in “Tips for choosing” section (check if provider licensed).

California DMV – Proof of Insurance

👉 https://www.dmv.ca.gov

- State-specific rule reference.

- Natural to cite in dealer coverage or cross-state validity.

Conclusion

Both temporary and dealer driveaway insurance keep you legal, but temporary coverage is usually cheaper, more flexible, and better for interstate driving. Dealer coverage is convenient but often overpriced.

For most buyers, temporary policies are the smart choice. Dealers or businesses moving multiple vehicles may benefit from dealer-linked or fleet coverage.

👉 Next steps: