Introduction to Traceloans.com Debt Consolidation

If juggling multiple credit card bills, medical expenses, or payday loans feels overwhelming, you might be considering traceloans.com debt consolidation in 2025. The promise sounds attractive: one loan, one payment, and less stress. But how does it really work, and is it the best choice for your financial situation? This guide uncovers the reality of traceloans.com debt consolidation—covering how it functions, the risks you need to watch for, and safer alternatives you should compare before deciding.

Start with our detailed Traceloans.com Review 2025 – Legit or Scam? Complete Guide for a deeper dive into how traceloans.com works

Why People Search for traceloans.com Debt Consolidation

- Rising debt stress in the U.S. – Millions of Americans face double-digit credit card APRs, making minimum payments impossible to keep up with.

- Desire for simplicity – Instead of 5 different due dates and penalties, one loan means one payment.

- Hope for lower costs – Borrowers are drawn to the idea of reducing monthly payments and saving on interest.

- Fresh start – Debt consolidation is often marketed as a way to regain control over financial health.

Key Points to Know Before Considering It

- traceloans.com debt consolidation is unverified: Unlike trusted lenders (SoFi, Upstart, LendingTree), traceloans.com provides limited transparency.

- APR details missing: Borrowers don’t know what rates they’ll actually pay until deep into the process.

- Risk of scams: Debt-related websites with little regulation history often attract bad actors.

- No major financial backing: Absence of state licensing or federal oversight raises red flags.

Safer Steps You Can Take

- Compare multiple licensed lenders side by side.

- Use tools like Experian Debt Consolidation Guide for unbiased insights.

- Always check licensing through the NMLS Consumer Access database.

- Read in-depth analysis like this Traceloans.com Review 2025 before committing.

👉 Bottom line: traceloans.com debt consolidation may seem like an easy escape from financial chaos, but due diligence is critical. This article will break down how the process works, the pros and cons, real-world examples, and smarter alternatives to protect your financial future

If you’re looking for mortgage loan details, see our full guide: TraceLoans.com Mortgage Loans (2025 Guide).

Table of Contents

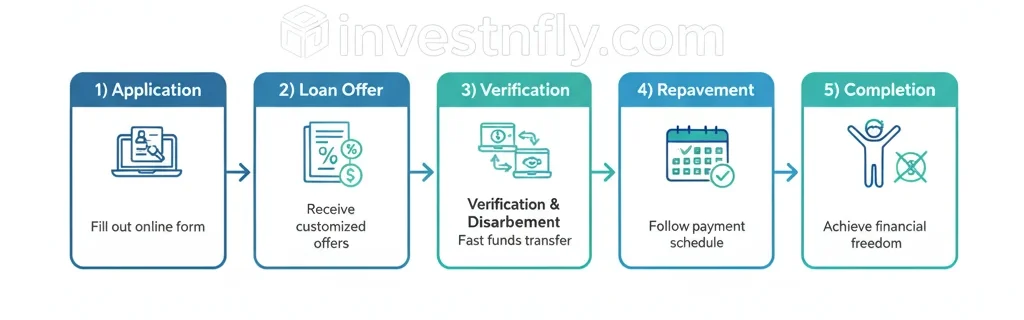

How traceloans.com Debt Consolidation Loans Work (Step-by-Step)

Most people hear the term debt consolidation and imagine one straightforward process: borrow a new loan, pay off all old debts, and make a single monthly payment. In reality, how it works depends heavily on the platform you choose. According to multiple independent reviews, traceloans.com does not appear to be a direct lender but more of a loan lead-generation service. This means it collects borrower information and may connect you with third-party lenders who issue the actual loan offers.

Here’s a step-by-step breakdown of how the process is typically promoted:

1. Application

You start by filling out a form with personal and financial details such as income, debt balances, and credit history. Unlike established lenders that clearly display licensing and APR ranges, traceloans.com’s site provides limited upfront information.

(See the CFPB guide on personal loan shopping for what details should always be disclosed.)

2. Loan Offer / Matchmaking

If your profile matches certain lenders, you may receive one or more offers. Since traceloans.com likely works as a lead-generator, these offers come from external financial institutions, not from traceloans.com itself. Transparency varies, and you might not know fees or APR until much later in the process.

3. Verification & Disbursement

Approved lenders usually perform a hard credit check before finalizing. Funds may then be disbursed either directly to you or used to pay off existing debts. Without clear disclosure from traceloans.com, it’s uncertain whether the money is always sent directly to creditors.

(For reference, see Experian’s overview of debt consolidation loans.)

4. Repayment

You make a single monthly payment toward the new loan. Ideally, the payment is lower than the combined total of your old debts. But beware: longer repayment terms can sometimes mean you pay more in interest overall.

5. Completion

Once the loan term (usually 2–5 years) is finished and all payments are made, your consolidated balance is cleared. If you’ve been consistent, your credit score may improve due to reduced credit utilization.

⚠️ Key Takeaways for Borrowers

- Unclear licensing: Always verify if the lender you’re matched with is licensed in your state (check the NMLS Consumer Access database).

- APR transparency missing: Unlike SoFi or LendingTree, traceloans.com does not openly display interest rate ranges.

- Lead generator, not lender: Be aware you are likely dealing with third-party companies.

👉 Bottom line: The mechanics of traceloans.com debt consolidation sound simple, but the lack of upfront disclosures makes it crucial to double-check the legitimacy of any lender you’re matched with.

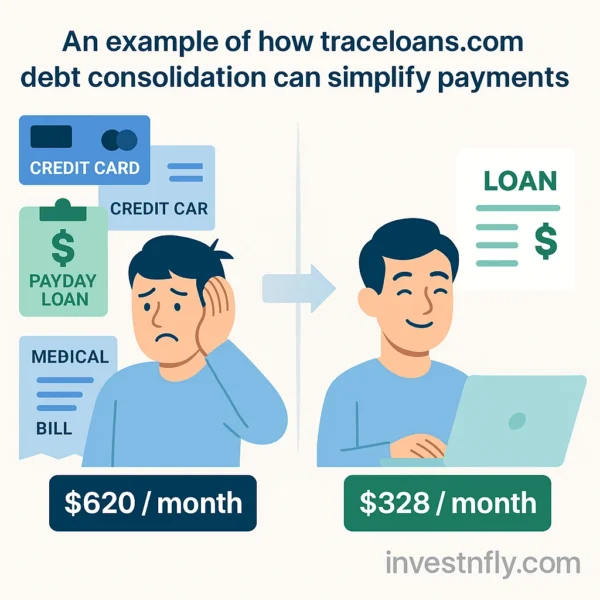

Example Calculation: Before vs. After Consolidation

One of the easiest ways to understand the potential impact of traceloans.com debt consolidation is through numbers. Let’s imagine a common scenario faced by many U.S. households: multiple debts with different interest rates, scattered due dates, and high minimum payments.

📊 Case Study: A Borrower with Four Debts

| Debt Type | Balance | APR | Monthly Payment |

|---|---|---|---|

| Credit Card 1 | $4,500 | 24% | $225 |

| Credit Card 2 | $2,500 | 22% | $125 |

| Medical Bill | $3,000 | 18% | $150 |

| Payday Loan | $2,000 | 28% | $120 |

| Total Before | $12,000 | – | $620 |

🔄 After Consolidation Loan (Example Scenario)

Suppose this borrower takes a single $12,000 consolidation loan through a lender found via traceloans.com at an estimated 14% APR over 48 months:

- Monthly Payment: ~$328

- Term Length: 4 years (48 months)

- Total Interest Paid: ~$3,750

- Monthly Savings: $292 compared to juggling four different payments

✅ The Upside

- Simplified finances – Only one payment date to remember, reducing late fees.

- Lower monthly outflow – Nearly $300 in cash flow freed up each month.

- Potential credit score boost – Paying off high-utilization credit cards can improve your score in a few months.

(See Investopedia’s breakdown on debt consolidation for more details.)

❌ The Hidden Cost

While the monthly savings look impressive, longer terms can mean paying more in total interest. For example:

- Keeping debts separate, if aggressively paid within 2 years → ~$2,800 total interest.

- Consolidating into a 4-year loan at 14% → ~$3,750 total interest.

So although the monthly payment drops, the borrower ends up paying nearly $1,000 extra in interest over time.

⚖️ What This Means for Borrowers

- If your priority is cash flow relief, a consolidation loan can make sense.

- If your goal is minimizing total cost, you may be better off snowballing or avalanche repayment strategies without extending the term.

- Using a platform like traceloans.com may connect you to lenders with variable terms, so it’s critical to compare offers carefully before committing.

(For strategies on repayment, see Experian’s guide to consolidation.)

👉 Bottom line: traceloans.com debt consolidation could reduce stress and monthly payments, but if the APR or loan term is unfavorable, you might save cash now while paying more overall.

After Consolidation Loan (Example Scenario)

| Debt Type | Balance | APR | Monthly Payment |

|---|---|---|---|

| Consolidated Loan | $12,000 | 14% | $328 |

| Total After | $12,000 | – | $328 |

Key Red Flags & Risks When Using traceloans.com for Consolidation

While debt consolidation can be an effective tool to simplify finances, using platforms that lack transparency carries significant risks. Based on research, traceloans.com debt consolidation shows several warning signs that borrowers should not ignore.

🚩 1. Lack of Licensing & Regulation Information

Legitimate lenders and marketplaces proudly display their state or federal licenses. On traceloans.com, no clear licensing details are visible, which makes it difficult to verify whether the company is operating under regulatory oversight.

👉 Always confirm through the NMLS Consumer Access database whether the lender you’re connected with is properly licensed.

🚩 2. Limited APR & Fee Transparency

Most credible lenders provide an APR range upfront (e.g., “7%–25% APR”) so borrowers know what to expect. Traceloans.com does not clearly list interest rates, origination fees, or penalty fees before you share your information. This lack of clarity can lead to surprises later in the process.

🚩 3. Lead Generator, Not a Direct Lender

The site appears to function mainly as a lead generator. That means you’re not borrowing directly from traceloans.com — instead, your personal information may be sent to multiple third-party lenders. This raises two risks:

- You may receive unwanted marketing calls or emails.

- The final offers may not match what was originally advertised.

🚩 4. Risk of Higher Total Cost

Even if your monthly payment drops, the loan term could be stretched longer. That means paying more in total interest. Some borrowers on forums have reported that “savings” were modest or vanished once all fees were factored in.

🚩 5. Customer Service Gaps

Unlike established lenders that offer phone, chat, or 24/7 support, traceloans.com does not clearly present verified contact methods. For a financial decision as important as debt consolidation, lack of reliable support is a red flag.

🚩 6. Data Privacy Concerns

Lead-generation platforms often share user data with their partner networks. Without clear disclosure policies, borrowers risk having sensitive financial information circulated more widely than expected.

⚖️ Takeaway

These risks don’t mean every borrower will have a negative outcome, but they do mean you must proceed with caution. If you choose to explore traceloans.com debt consolidation, double-check:

- Licensing of the actual lender,

- APR and fees disclosed in writing,

- Privacy policies and data usage terms.

For additional guidance, see the CFPB’s tips on spotting and avoiding debt relief scams.

👉 Bottom line: Transparency is key. Without it, debt consolidation can create more problems than it solves.

Safer Alternatives to traceloans.com

While traceloans.com debt consolidation might appear attractive at first glance, its limited transparency makes it risky. If you are serious about consolidating debt, it’s wise to explore safer, regulated alternatives. These options are backed by licenses, clearer disclosures, and stronger customer protections.

✅ 1. SoFi Personal Loans

- APR Range: 8% – 25% (varies by credit score).

- Features: No origination fees, unemployment protection, and rate discounts for autopay.

- Why Safer: SoFi is a well-established, licensed lender with clear disclosures.

✅ 2. Upstart

- APR Range: 7% – 29% (depending on credit).

- Features: Uses AI-driven underwriting, making it accessible for borrowers with thin or fair credit history.

- Why Safer: Licensed and reports to credit bureaus, improving transparency.

✅ 3. LendingTree

- Service Type: Marketplace that lets you compare offers from multiple lenders.

- Features: Real-time APR ranges, flexible terms, and access to customer reviews.

- Why Safer: Well-known, regulated comparison platform in the U.S.

✅ 4. Credit Unions

- APR Range: Often lower than big banks for members.

- Features: Non-profit model allows for more favorable loan terms.

- Why Safer: Federally insured and member-focused.

✅ 5. Debt Management Plans (DMPs) via Nonprofits

- Offered by: Accredited agencies like NFCC.

- Features: Negotiated lower interest rates with creditors, structured repayment plans.

- Why Safer: Nonprofit organizations prioritize consumer protection over profit.

📌 External Resources

- Experian: How debt consolidation works

- Investopedia: Pros and cons of debt consolidation

- CFPB: Choosing a personal loan

👉 Bottom line: Before considering traceloans.com debt consolidation, compare offers from regulated lenders. Transparency and consumer protection matter more than convenience.

Comparison: traceloans.com vs SoFi / Upstart / LendingTree

When it comes to choosing a debt consolidation option, it’s important to compare platforms based on transparency, regulation, and consumer protection. Below is a side-by-side breakdown showing how traceloans.com debt consolidation stacks up against three widely recognized alternatives: SoFi, Upstart, and LendingTree.

📊 Comparison Table

| Feature / Factor | traceloans.com (Lead Generator) | SoFi (Licensed Lender) | Upstart (Licensed Lender) | LendingTree (Licensed Marketplace) |

|---|---|---|---|---|

| Type of Service | Loan-matching / lead generator | Direct personal lender | Direct personal lender | Loan comparison marketplace |

| APR Transparency | Not disclosed upfront | 8% – 25% (published) | 7% – 29% (published) | Varies by lender, disclosed early |

| Licensing | No verified public info | Licensed & regulated | Licensed & regulated | Licensed U.S. marketplace |

| Credit Reporting | Unknown | Reports to bureaus | Reports to bureaus | Depends on lender, usually yes |

| Customer Support | Limited visibility | Phone, app, online chat | Phone & online support | Multiple support channels |

| Data Privacy | May share with partner lenders | Strict privacy policies | Transparent data use | Clear disclosures, opt-out options |

| Pros | One form, multiple lender matches | Clear terms, perks | Accessible for fair credit | Compare multiple lenders at once |

| Cons | Lacks licensing info, hidden APR | Best rates require high credit | Rates high for poor credit | Offers vary by lender |

| Verdict | High-risk due to lack of transparency | Safer, regulated choice | Safer, regulated choice | Safer, regulated marketplace |

🔎 What the Comparison Shows

- Service Type Difference

- traceloans.com: Lead generator — collects borrower info and forwards it to partner lenders.

- SoFi & Upstart: Direct licensed lenders with clear APR ranges and consumer protections.

- LendingTree: Marketplace showing transparent offers from multiple licensed lenders.

- Transparency & Licensing

- traceloans.com has no clear APR range or licensing details visible online.

- Competitors display APRs upfront and are easy to verify in the NMLS database.

- Data Privacy Risks

- traceloans.com may share borrower data with multiple partners, leading to marketing calls/emails.

- Trusted lenders like SoFi/Upstart follow strict privacy policies, while LendingTree provides disclosure statements.

- Consumer Protection

- Established lenders have complaint mechanisms (BBB, CFPB) and customer support teams.

- traceloans.com lacks verifiable consumer support channels.

⚖️ Bottom Line

Comparing all four side by side, traceloans.com debt consolidation is riskier because it functions mainly as a loan-matching platform without verified regulatory oversight. Borrowers looking for debt relief should lean toward transparent, licensed lenders such as SoFi and Upstart, or marketplaces like LendingTree that openly disclose APR ranges and regulatory information.

(See CFPB guide on choosing safe loans for more info.)

Disclaimer: Information about traceloans.com being a lead generator or loan-matching service is based on third-party review sites and user discussions (e.g., Reddit threads, PartyPrott.com, TechScoopNow.com). As of 2025, no official licensing details are publicly verifiable through NMLS or government registries. Readers should independently verify any lender’s regulatory status before applying.

Real User Reviews & Feedback — traceloans.com dept consolidation

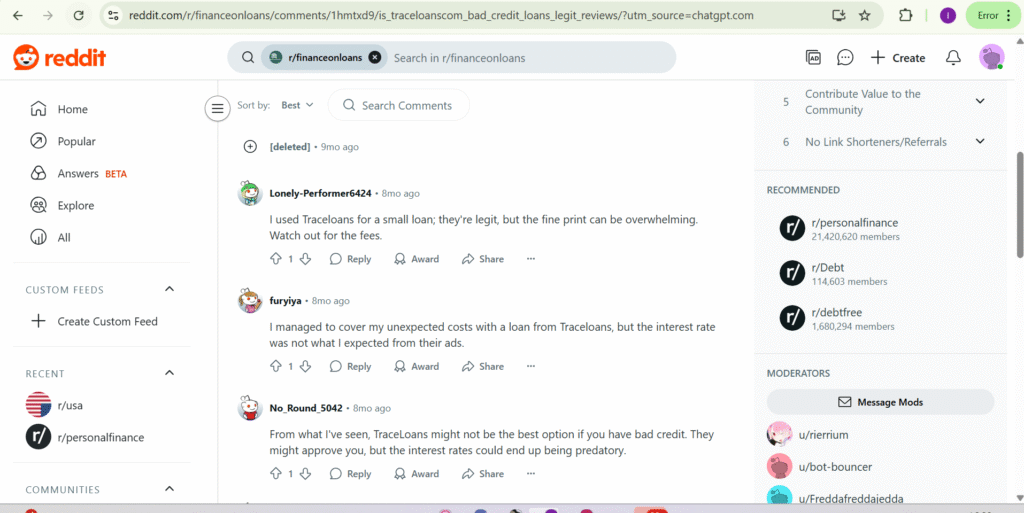

Understanding real borrower experiences is just as important as reading marketing claims. To make this guide more transparent, we reviewed user feedback from Reddit, Quora, and independent blogs. Here’s a summary of what people are saying:

📊 Review Summary Table

| Source | Positive Feedback | Negative Feedback | Link |

|---|---|---|---|

| Reddit (r/financeonloans) | Some users said they were matched with lenders; application was easy. | APRs often higher than expected; fine print confusing; works as a lead generator. | Reddit Thread 1 |

| Reddit (2nd Thread) | Quick pre-qualification with no hard pull at first. | Final terms included higher fees; offers didn’t match ads. | Reddit Thread 2 |

| Quora | Easy UI; borrowers liked ability to compare options. | Concerns about lack of licensing and unclear APR. | Quora Discussion |

| PartyPrott Blog | One form → multiple offers; soft credit check claimed. | No direct lending; missing licensing details. | PartyPrott Review |

| TechScoopNow Blog | Explains domain history and aggregator role. | Notes lack of verified licensing or registration. | TechScoopNow |

| JobWorkly Blog | Describes student loan matching feature. | Confirms they are an aggregator, not a direct lender. | JobWorkly Review |

🔎 Key Takeaways from User Feedback

- Ease of use: Borrowers find the site simple to navigate.

- Mixed trust: Some did receive offers, but rates were higher than expected.

- Lead generator role: Multiple reviews confirm traceloans.com is not a direct lender but a loan-matching platform.

- Transparency issues: Licensing details and upfront APR ranges are missing, which worries users.

📌 Disclaimer

The above feedback is compiled from third-party forums (Reddit, Quora) and independent review sites (PartyPrott, TechScoopNow, JobWorkly). Individual experiences may vary. Always verify licensing with the NMLS Consumer Access database before applying.

❓ Frequently Asked Questions (FAQ)

1. What is traceloans.com debt consolidation?

traceloans.com debt consolidation refers to using the traceloans.com platform to match with lenders that may provide personal loans to pay off multiple debts. It works more like a loan-matching service than a direct lender.

2. Is traceloans.com a legitimate place to consolidate debt?

Independent reviews suggest that traceloans.com functions as a lead generator, not a direct lender. While some users report receiving offers, there are concerns about transparency, licensing, and APR disclosure. Borrowers should verify lenders through the NMLS Consumer Access database.

3. How does traceloans.com debt consolidation compare with SoFi or Upstart?

Unlike SoFi and Upstart, which are licensed direct lenders with published APR ranges, traceloans.com debt consolidation does not provide clear APRs or licensing details upfront. This makes it less transparent compared to established options.

4. Can using traceloans.com debt consolidation lower my monthly payments?

Yes, it can potentially lower monthly payments if you are matched with a lender offering a lower APR or longer repayment term. However, extending repayment can mean paying more interest in the long run.

5. What risks should I consider before applying with traceloans.com?

Key risks include:

- Lack of clear licensing details,

- Limited APR and fee transparency,

- Personal information being shared with multiple lenders,

- Risk of higher long-term interest costs.

6. Are there safer alternatives to traceloans.com debt consolidation?

Yes. Licensed lenders such as SoFi, Upstart, and marketplaces like LendingTree provide clearer APR disclosures and stronger consumer protections. Nonprofit credit counseling agencies like the NFCC also offer safer debt management options.

7. Should I trust online reviews about traceloans.com debt consolidation?

Online reviews can be helpful, but they are mixed. Reddit and Quora users often mention higher-than-expected APRs and unclear fine print. Always treat online feedback as one input and verify lender details independently.

Conclusion: Should You Choose traceloans.com Debt Consolidation?

Debt consolidation can be a valuable strategy when done with the right lender. It simplifies your finances, reduces stress, and can even improve your credit profile. But choosing the wrong platform can make things worse instead of better.

Based on user feedback, third-party reviews, and independent research, traceloans.com debt consolidation appears to function more as a loan-matching service than a licensed direct lender. While the promise of “one form, multiple offers” sounds convenient, the lack of verified licensing, missing APR ranges, and unclear privacy policies mean borrowers must proceed cautiously.

If your goal is lower monthly payments and better financial control, safer alternatives exist — including regulated lenders like SoFi, Upstart, and marketplaces like LendingTree. Nonprofit credit counseling through organizations such as the NFCC may also provide structured repayment without the risks associated with unverified sites.

✅ What You Should Do Next

- Compare multiple loan options on trusted, regulated platforms.

- Always verify any lender in the NMLS Consumer Access database.

- If you do try traceloans.com, review every offer carefully — APR, term length, and fees in writing — before signing.

- Consider safer alternatives and credit counseling if transparency is your priority.

👉 Bottom line: traceloans.com debt consolidation may provide convenience, but until it shows stronger transparency and licensing, borrowers are better served by regulated lenders and nonprofit programs.

📌 Ready to learn more? Start with our detailed Traceloans.com Review 2025 – Legit or Scam? Complete Guide for a deeper dive into how traceloans.com works and whether it fits your situation.